Index

Markets

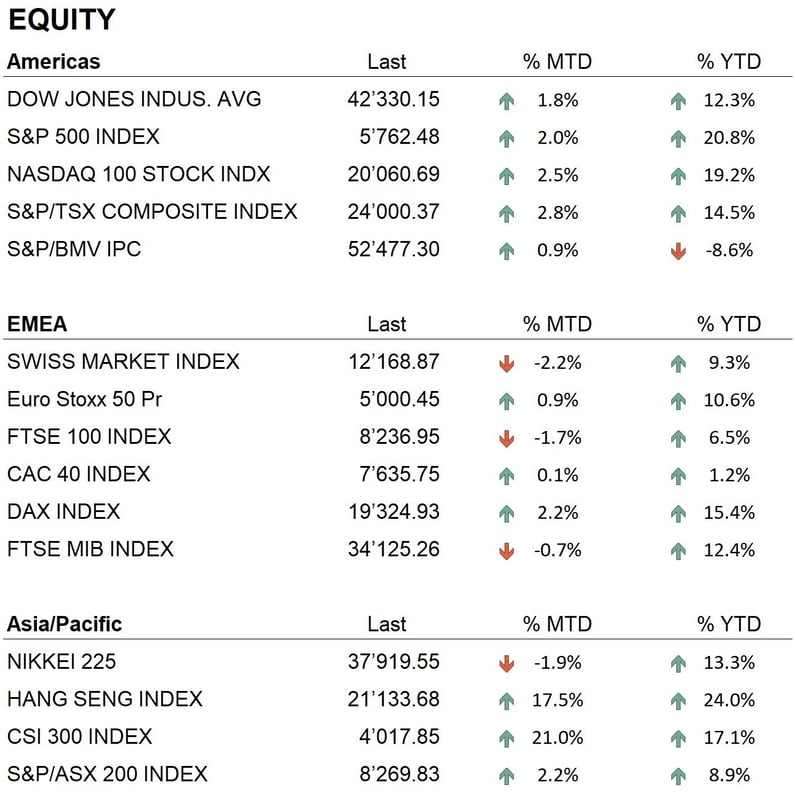

In September 2024, global markets rebounded significantly, with most indexes ending the month in positive territory. In the United States, the S&P 500 rose by 2%, supported by favorable macroeconomic data and expectations of monetary easing by the Federal Reserve. The Nasdaq 100 also benefited from strong demand for technology stocks, increasing by 2.5%, while the Dow Jones posted more moderate growth, rising by 1.8%.

In Europe, markets were boosted by lower-than-expected inflation and expectations for further rate cuts by the ECB. Despite a decline in the German manufacturing PMI, the Eurostoxx 50 ended the month up by 0.9%, outperforming the negative expectations at the start of the month.

In Asia, the Chinese market saw a strong rally, with the Hang Seng Index gaining more than 17%, driven by massive economic stimulus measures from the government to support the real estate sector and the broader economic recovery. In contrast, Japan reported weaker performance, with the Nikkei 225 falling by 1.9%.

In September, the Federal Reserve cut interest rates by 50 basis points, bringing the benchmark rate to 5%. This marked the beginning of a round of monetary easing aimed at countering the economic slowdown and reducing inflationary pressures. Meanwhile, the European Central Bank cut rates to 3.5% in response to declining inflation, while the Swiss National Bank took a cautious approach, lowering its benchmark rate to 1% while maintaining the stability of the Swiss franc.

Gold continued its upward trend, closing at $2,634 an ounce, up 5.2% from the beginning of the month. Silver also performed well, reaching $32 an ounce during the month and closing at $31.16, up 8%.

In the cryptocurrency sector, Bitcoin reached a high of $66,000 toward the end of the month, closing at $63,785 with an 8% rise since the end of August. This increase was driven by improving investor sentiment and expectations of more accommodative monetary policies from the Fed following the summer correction. Ethereum also closed higher, reaching $2,613 with a 3.8% increase, confirming renewed investor interest in cryptocurrencies.

Economy

U.S. inflation data continued to show signs of a slowdown. The August Consumer Price Index, released in September, showed an annual increase of 2.5%, confirming the disinflationary trend that characterized the summer, largely due to the stabilization of energy prices.

In Europe, inflation fell further to 2.2% in the euro area, bringing it closer to the ECB's target.

However, economic growth remains fragile, with weak domestic demand and a struggling manufacturing sector, particularly in Germany, where the automotive industry is under pressure due to falling global demand and the transition to electric vehicles. The German economy, already in recession, is expected to end 2024 with negative growth.

Geopolitics

In September 2024, the conflict between Israel and Hezbollah escalated dramatically. Israel conducted a targeted attack against the Lebanese organization, using explosive devices concealed in pagers and walkie-talkies, killing dozens of Hezbollah members and injuring hundreds of civilians. Additionally, a coordinated strike resulted in the elimination of Hassan Nasrallah, Hezbollah's leader for more than 30 years. This event triggered a strong political response from Lebanon, raising the risk of a broader regional conflict.

Meanwhile, in Ukraine, the war with Russia continued in the Donetsk and Zaporizhzhia regions. In September, Ukrainian forces launched several counteroffensives to reclaim occupied territories. NATO support, including drones and advanced weaponry, has enhanced Ukraine's military capabilities. However, the conflict remains critical, with a high number of civilian casualties.

Conclusions

Overall, financial markets continued to show signs of recovery in September 2024, supported by expectations of further monetary easing from major central banks. In the United States, the Federal Reserve’s interest rate cut boosted equity indexes, while in China, economic stimulus policies drove markets sharply higher. However, the bond market remains uncertain, with yields influenced by upcoming central bank decisions and global inflation trends.

In Europe, despite slowing inflation, challenges persist in the manufacturing sector and domestic demand remains weak, particularly in Germany, which continues to weigh on the region's economic recovery. On the geopolitical front, tensions in the Middle East and the war in Ukraine remain significant risk factors. The escalating conflict between Israel and Hezbollah, along with developments in Ukraine, could sustain high volatility in international markets.

Amid this backdrop, gold reached new all-time highs in September, solidifying its status as a safe-haven asset in a climate of global uncertainty. The cryptocurrency market also experienced significant growth, with Bitcoin and Ethereum posting sharp gains, outperforming traditional equity markets.

In light of these dynamics, we maintain a slight overweight in both gold and equities, as we believe these exposures continue to offer attractive opportunities in the current market environment

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Information Technology

- Healthcare

Market data (data as of 30.09.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.