Index

Markets

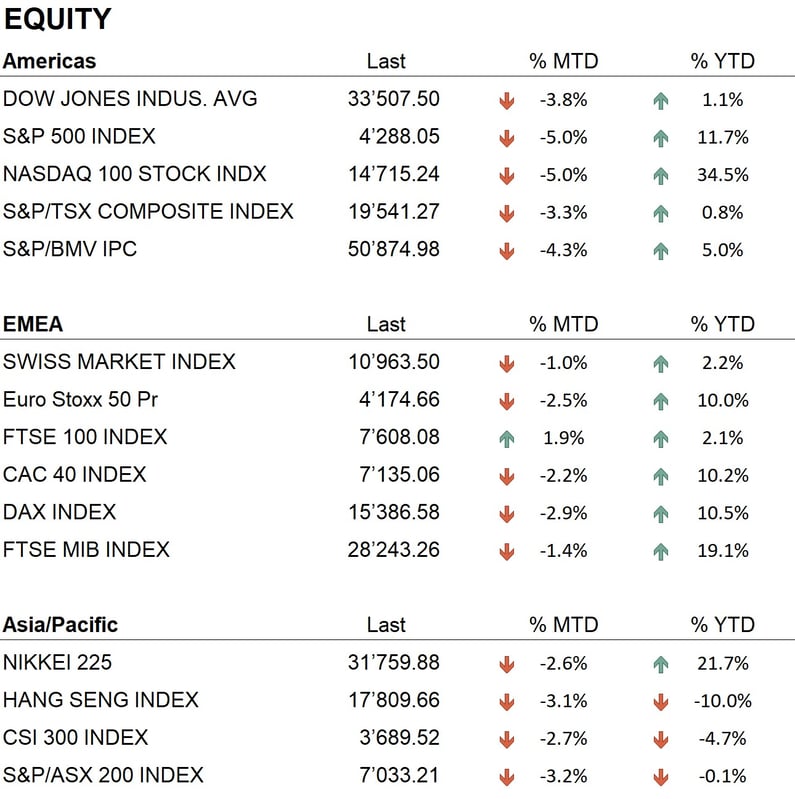

The month of September ended with negative performance in all major stock exchanges worldwide. U.S. indices performed negatively, with the Dow Jones losing 3.5% and the S&P500 and Nasdaq 100 losing 5.00%.

European indices followed suit, with the Eurostoxx 600, the Dax, and the Swiss stock market losing 1.74%, 3.51%, and 1.46% respectively. Asian markets also struggled; the Nikkei decreased by 2.60% and Hong Kong by 3.10%, marking September as the worst month of 2023.

Despite this decline, year-to-date performance remains positive: the Dow Jones is up 1.1%, the S&P 500 11.7%, the Nasdaq 34.5%, the Eurostoxx 10%, the Dax 10.5%, and the Swiss stock market 2.2%. In contrast, Asia's Nikkei has surged by 22.1%, but the Chinese stock exchanges are in the negative, with Hong Kong at -10% and Shenzhen at -4.7%. The downturn in Chinese markets is attributed to the ongoing real estate crisis in the country, leading to multiple bankruptcies of major real estate firms.

In the bond market, September was notable for the meetings of several central banks. The Federal Reserve, on September 20th, maintained the benchmark rate at 5.5%. Meanwhile, the European Central Bank increased the rate by 0.25% to 4.50% on September 14th. The Swiss National Bank kept its rate steady at 1.75% on September 21st, catching the market off-guard, which had anticipated a 0.25% increase.

In currency markets, the U.S. dollar continued its positive trajectory against most major world currencies, started in mid-July. It appreciated from 1.0950 to 1.06 against the euro, even reaching a low of 1.05. This dollar strength impacted metal prices adversely; gold, for instance, fell from around $1,950 per ounce at the beginning of the month to around $1,870 per ounce at the close. The cryptocurrency market remained stable, with Bitcoin trading around $27,000 against the dollar by the month-end.

Economy

During the month, the final data on GDP growth for the second quarter of 2023 were released. The United States exhibited a growth of 2.1%, while the eurozone showed a modest 0.5% growth. Notably, Germany experienced negative growth of -0.1%, marking two consecutive quarters of contraction and indicating a de facto recession. This is alarming for the future of the European economy as Germany is considered the economic locomotive of Europe, and its slowdown could have ripple effects across the continent. For other European countries, France saw a growth of 1%, Italy 0.4%, Spain a significant 2.2%, and Switzerland 0.5%.

We also observed the release of the latest inflation data, showing signs of a slowdown. Inflation has decreased to 3.7% in the United States, while it sits at 4.8% in Europe.

In terms of economic forecasts, several downward revisions have been noted. The United States is projected to close the year with around 2.3% growth, with 2024 forecasts indicating a more modest 1% growth. For the Eurozone, the growth is expected to be 0.5% this year and 0.8% in 2024. China is anticipated to experience a 5% growth in 2023 and 4.5% in 2024. However, the ongoing real estate crisis poses a significant impact, thus these figures are subject to confirmation.

Geopolitics

Geopolitically, September was relatively quiet, with no major developments. The longstanding conflict between Russia and Ukraine remained a focal point, and as previously mentioned, appears to have reached a stalemate. In fact, the offensive that Ukraine announced for the summer did not yield the anticipated results, leaving the front lines largely unchanged since the beginning of the year. This status quo benefits Russia, which continues to defend the territories it occupies, while Ukraine struggles to make headway, despite significant support from Western nations.

Another notable development with implications for both economics and geopolitics was the announcement by Saudi Arabia and Russia of a reduction in oil production. This came precisely when U.S. strategic reserves were at their lowest since 2022. Consequently, oil prices surged by US$10 in September and are currently positioned at US$92 per barrel.

Conclusions

The decline in equity markets in September can be perceived as a correction phase of the trend that has been present since the beginning of the year. Currently, the medium- and long-term positive trends have not been compromised. The bond sector, heavily influenced by the monetary policies of central banks, continues to exhibit a negative trend across most global indices.

Our investment policies have taken a defensive tactical stance, maintaining a slightly underweight exposure in the equity sector and holding an average portfolio duration of less than three years in the bond sector.

Presently, the most attractive sectors for investment in the equity market include technology, financial services, and energy. Conversely, in the bond market, preferred maturities range from two to four years for investment-grade bonds.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Energy

- Information Technology

- Financials

Market data (data as of 29.09.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.