Index

Markets

November 2025 was a month marked by greater uncertainty in global markets, with wider movements and varying results across the main regions. Changes in expectations regarding future rate cuts and weakness in Asian markets influenced overall performance. Technology stocks, particularly those related to artificial intelligence, underwent a correction after strong gains in previous months, while Europe and Switzerland showed greater stability thanks to support from defensive and pharmaceutical sectors.

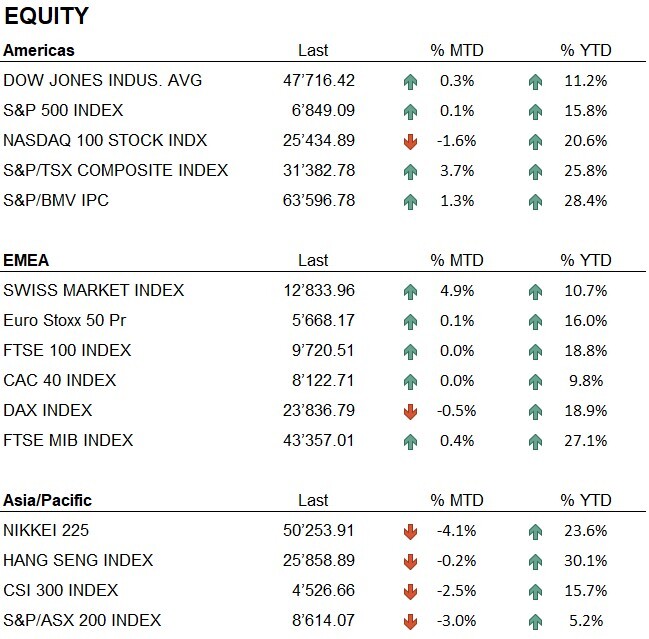

In the United States, the S&P 500 remained largely unchanged, rising 0.1%, while the Nasdaq 100 corrected by -1.6% and the Dow Jones closed up 0.3%. In Europe, the Euro Stoxx 50 ended the month up 0.1%, while the CAC 40 and FTSE 100 showed no change. The German DAX fell by -0.5%, while the Swiss SMI stood out with a gain of 4.9%.

In Asia, the Nikkei 225 corrected by -4.1%, the Chinese CSI 300 fell by -2.5%, and the Hang Seng closed with a slight decline of -0.2%.

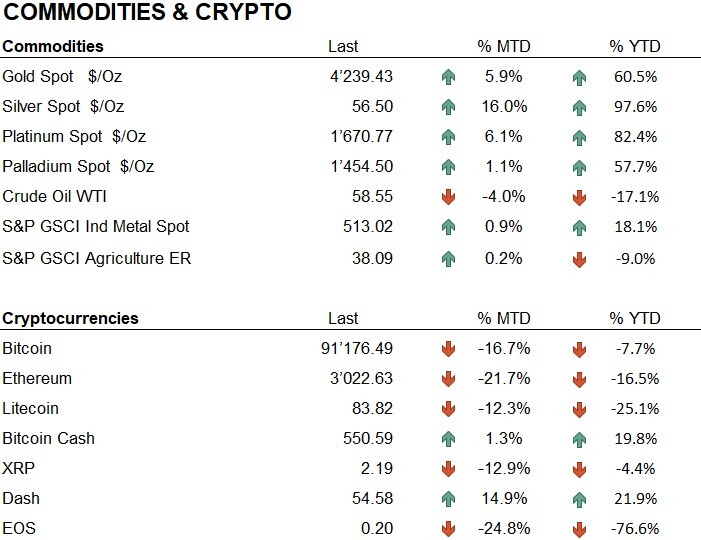

Gold continued its positive trend, closing at USD 4,239.43 per ounce, up 5.9% for the month and 60.5% since the beginning of the year. Silver ended at USD 56.50, up 16.0%, but remained more volatile than gold.

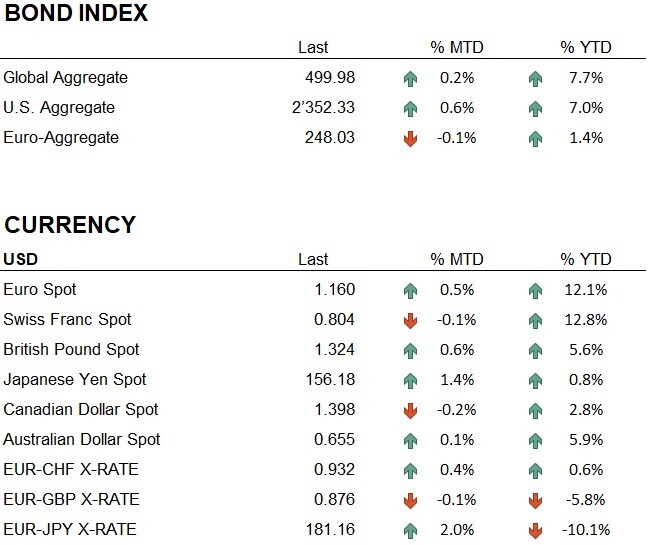

In the currency market, the euro appreciated by 0.5% against the dollar, while the Swiss franc fell by -0.1% against the USD. The Japanese yen recovered, rising 1.4%.

The crypto sector corrected significantly. Bitcoin recorded a loss of -16.7% and Ethereum fell by -21.7%. The weakness was driven by reduced risk appetite, forced liquidations of leveraged positions, and outflows from crypto ETFs, in a more cautious macroeconomic environment.

Overall, November was marked by sudden movements and rapid reversals, fueled by uncertainty over the timing of future rate cuts by the Federal Reserve and the absence of macro data for much of the month due to the federal shutdown. This made the market environment more difficult to interpret and accentuated volatility.

Economy

In the United States, November was shaped by the end of the long federal shutdown, which concluded on November 12 after 43 days. The delay in the publication of key indicators, such as inflation and labor market data, made it more difficult to assess the direction of the economy.

Expectations regarding future rate cuts by the Federal Reserve shifted several times throughout the month. At the beginning of November, the market still considered a first move in December a real possibility, but the delay in macroeconomic data and the resilience of certain sectors weakened this assumption. Only later did more accommodative comments from Fed officials restore a degree of optimism, although this also contributed to elevated volatility, with markets reacting immediately to every new macroeconomic signal.

Geopolitics

On the Ukrainian front, the conflict remained intense. Russia continued to target energy and logistics infrastructure, while Ukrainian forces carried out strikes deep into Russian territory. The United States sought to reopen diplomatic channels between the parties, but there were no concrete signs of a ceasefire.

In November, tensions between the United States and Venezuela increased. Washington ordered the closure of the airspace around the country and reinforced its military presence in the Caribbean Sea. Several US naval operations resulted in the sinking of vessels believed to be involved in illegal trafficking. Caracas denounced the actions as a violation of its sovereignty and accused the United States of a dangerous escalation. The situation keeps geopolitical uncertainty in the region elevated, with potential repercussions for local energy dynamics.

Conclusions

In November, we adjusted the portfolio's allocation in response to increased volatility. The equity component was reduced, while liquidity was increased to ensure greater operational flexibility in a market characterized by rapid movements. The position in gold, which had already been increased in previous months, was raised slightly, and we maintain our overweight position. Geographically, we maintain a neutral positioning, with a slight overweight in North America in line with our model signals.

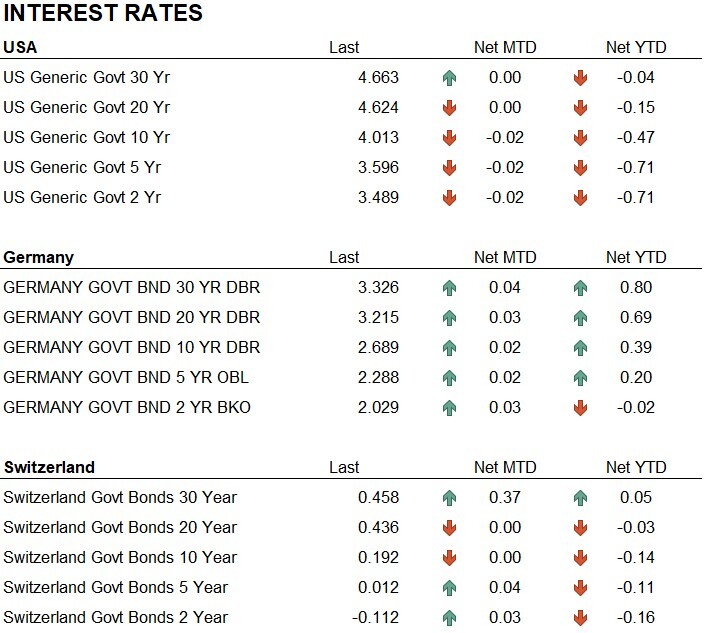

On the bond front, we maintain a neutral position ahead of the Fed's December meeting, which the market expects to be the first possible rate cut of at least 0.25%. US yields ended the period largely unchanged, while in Europe they rose by a few basis points, remaining in a sideways trend thanks to inflation under control.

The month was characterized by sudden changes in direction. We monitor the markets daily and adjust the portfolio regularly to maintain a position consistent with developments in the environment. The asset allocation reported is a snapshot at the end of the month: thanks to the signals from our model, we maintain the ability to quickly adjust our position in the event of changes in the market environment.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Industrials

- Materials

Market data (data as of 28.11.2025)

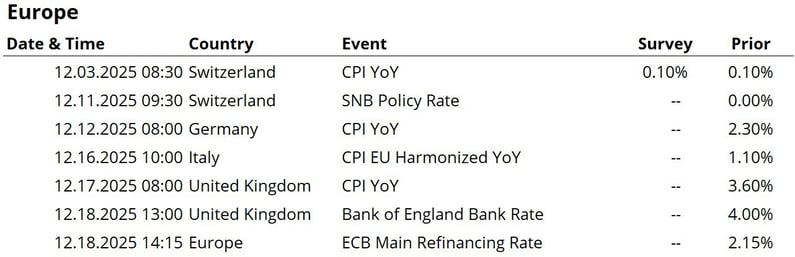

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.