Index

Markets

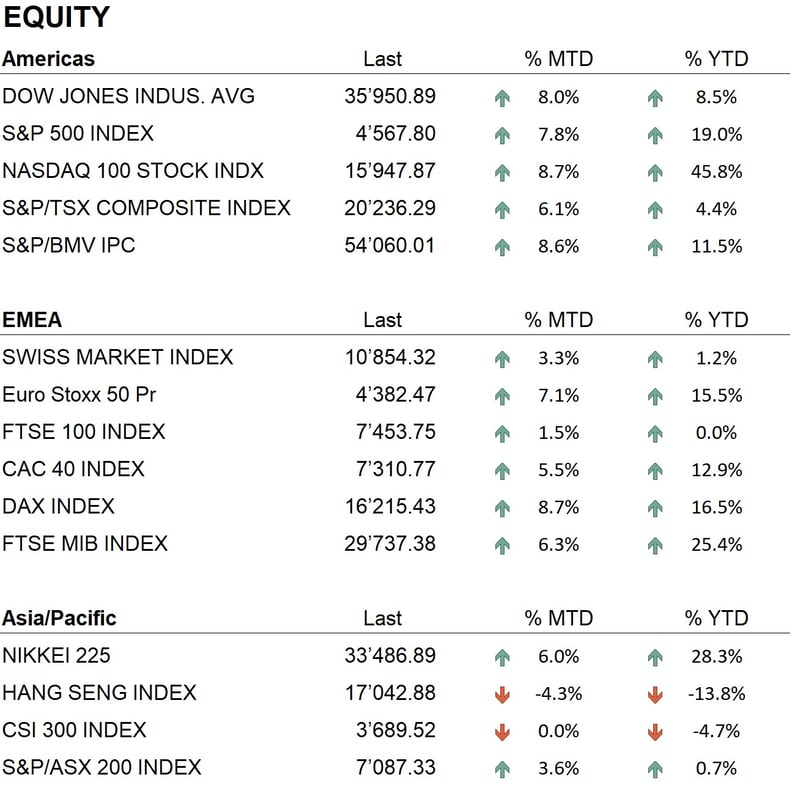

November 2023 closed with excellent performance in major world stock markets, recovering the losses accumulated in September and October and reaching new annual highs. In some cases, markets approached all-time highs. In the United States, the Dow Jones rose by 8%, the S&P500 by 7.8%, and the Nasdaq 100 by 8.7%, bringing their performance since the beginning of the year to 8.5%, 19%, and 45.8%, respectively. In Europe, the Eurostoxx 50 increased by 7.1%, the Dax by 8.7%, and the SMI by 3.3%, with year-to-date performances of 15.5% for the Eurostoxx, 16.5% for the Dax and 1.2% for the SMI. In Asia, the Nikkei closed the month up 6%, bringing its year-to-date performance to 28.3%. In contrast, Chinese indices showed a different trend: the Hang Seng had a negative annual performance of 13.8% and the CSI300 of 4.7%. This negative trend in Chinese markets, significantly impacted by the real estate crisis, continued to weigh on the region's economy.

In the bond sector, November was particularly positive. After recent highs in euro and dollar rates, significant declines occurred, especially on the middle to long end of the curve. The 10-year Treasury started the month with a yield of 4.90% and closed at 4.30%, while the German Bund dropped from 2.85% to approximately 2.40%. This drop in yields followed the release of some economic data and comments by central bankers, suggesting the end of the restrictive monetary policy phase and anticipating possible rate cuts in 2024.

In the currency sphere, the decline in rates hurt the dollar, which weakened against all major currencies. At the end of November, the euro/dollar exchange rate stood at 1.10, a monthly decline of 5%. The Dollar Index also fell 4%, indicating a phase of global weakness for the dollar. However, the dollar's weakness favored precious metals: gold surpassed $2,000 an ounce, closing the month at $2,050, close to its 2020 all-time high. Bitcoin reached levels above $38,000, its highest in 18 months.

Economy

On the economic front, inflation data were released in both the United States and Europe. In the U.S., prices rose 3.2% year-on-year, slightly below the expectations of 3.3%. In Europe, inflation in November stood at 2.4%, down from 3% in the previous month. These data confirm a downward trend in inflation in both the United States and Europe. Economic growth data showed a divergence: in the United States, growth remained positive, while in Europe, the latest figure showed a decline of 0.1%, signaling an economy close to recession. The situation in Germany, facing a recession and a political crisis related to the budget law, was particularly concerning.

Geopolitics

Geopolitical tensions remained high. The conflict between Israel and Hamas in the Gaza Strip escalated, with only a brief truce and hostage exchange in recent days. Despite international pressure, a solution to the conflict seemed far off. The crisis in the Middle East temporarily overshadowed the conflict between Russia and Ukraine, which continued intensely without significant progress on either side. In Asia, the upcoming elections in Taiwan, scheduled for January 2024, were awaited with interest due to their implications for local political stability and U.S.-China relations.

Conclusions

Markets showed a strong recovery in November, both in equity and bond sectors globally, pointing to a positive close for 2023 that allowed them to recover much of the difficulties encountered in 2022. Major market movements were not expected in the final stages of the year; equity and bond trends remained positive. The recovery in precious metals and cryptocurrency prices had a beneficial effect on our operating results. Globally, during November, we increased our equity weighting, now finding ourselves in an overweight position.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Financials

- Energy

Market data (data as of 30.11.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.