Index

Markets

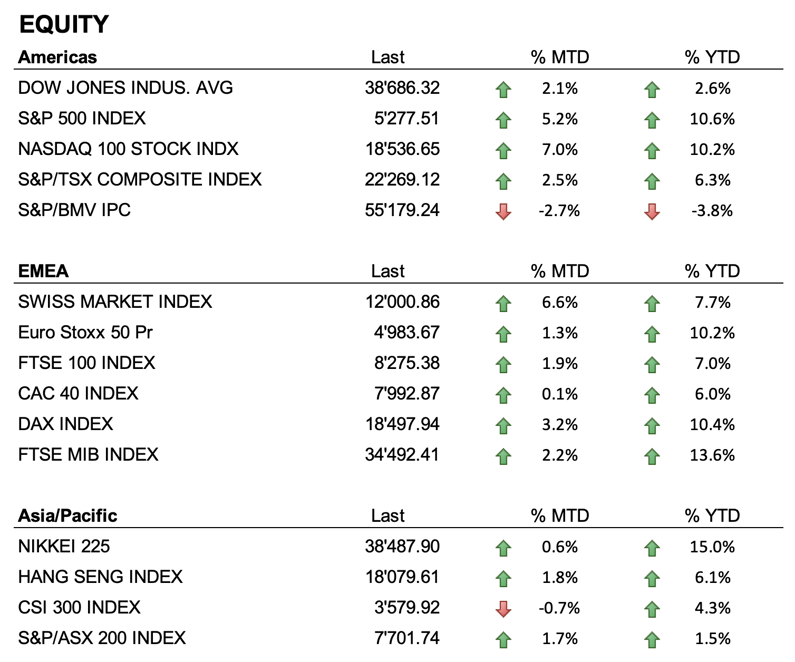

The month of May saw a positive trend in the prices of the world's major stock exchanges, recovering and overcoming the losses they had in the previous month. Since the beginning of the month (MTD), U.S. indices have posted major gains on the back of good quarterly reports and favorable economic data: the Dow Jones rose 2.1%, the S&P 500 5.2% and the Nasdaq 100 7%. Similarly, in Europe, indexes showed good performance, with the Eurostoxx 50 up 1.3%, the DAX up 3.2% and the SMI up 6.6%. In Asia, markets performed slightly positively, with the Nikkei seeing an increase of 0.6%, while in China, the Hang Seng index achieved a positive monthly performance with an increase of 1.8% and the CSI 300 saw a slight decrease of -0.7%.

The bond sector experienced considerable volatility during May 2024. The release of the latest U.S. inflation data revealed that the inflationary phenomenon persists, but with signs of slowing from previous months. As a result, 10-year Treasury yields fell, dropping from 4.7% in early May to 4.45% toward the end of the month. The Federal Reserve has hinted that rate cuts, initially scheduled for May, may be postponed until late summer, keeping uncertainty in the market high. In Europe, inflation has been less aggressive than expected, with the European Central Bank poised to lower rates starting in June. This helped keep bond market volatility high, negatively affecting bond valuations and leaving major global bond indices in negative territory.

On the currency front, the month of May saw a slight weakening of the dollar against the euro, rising from 1.0700 to 1.0850. The greenback remains mostly unchanged against the Swiss franc and the yen, while the euro strengthens its position against these two currencies.

In precious metals, gold reached record levels, surpassing $2,400 an ounce, supported by strong purchases by Asian central banks and growing demand for safe-haven assets. Silver also performed well, with the price reaching $32.52 an ounce. This increase was fueled by strong industrial demand related to green technologies and vehicle electrification, as well as growing demand for the physical metal as a safe haven asset.

In the cryptocurrency market, Bitcoin showed strong growth during May, reaching values above $71,000, while Ethereum surpassed $4,000 after the SEC approved a spot ETF on Ethereum. According to industry experts, the next spot ETFs may be on cryptocurrencies such as Solana and Ripple, the fifth and seventh largest cryptocurrencies by capitalization, respectively, but that is not until 2025.

Economy

During May, the release of the latest U.S. inflation data indicated signs of a downward trend. The consumer price index (CPI) rose 3.4% year-on-year, in line with expectations, while on a monthly basis it rose 0.3%, below analysts' expectations, suggesting a slowdown in inflation. This figure positively surprised markets, which reacted with a sharp rise on the day of publication, reflecting investors' optimistic interpretation of the economy's resilience. At its meeting earlier this month, the Federal Reserve decided to keep interest rates unchanged in the range of 5.25% to 5.50%, a decision that was widely expected by analysts.

Geopolitics

The conflict between Russia and Ukraine remains acute, with Russian forces intensifying attacks in the Kharkiv and Donetsk regions. Ukrainian forces have continued to seek additional military and economic aid from NATO countries. U.S. support remains crucial, with new aid packages under discussion. The situation on the ground continues to be critical, with significant casualties on both sides and growing concerns for the civilian population

In the Middle East, clashes between Hamas and Israel have intensified, particularly in the Rafah area. On May 27, 2024, an Israeli bombing hit a refugee camp in Rafah, killing many Palestinians, including many children and women. In addition, there were firefights between Egyptian and Israeli border guards, further increasing tension in the region. Several European countries, including Spain, Ireland and Norway, have begun to officially recognize the State of Palestine. In a recent call with Israeli Prime Minister Benjamin Netanyahu, President Joe Biden expressed significant frustration with Israel's handling of the situation in Gaza, stressing the unacceptability of the humanitarian situation and the importance of an immediate cease-fire and concrete actions to protect civilians and facilitate humanitarian aid.

Another significant event was the crash of a helicopter carrying Iranian President Ebrahim Raisi and Foreign Minister Hossein Amir-Abdollahian. The crash, which occurred on May 19, 2024, resulted in the death of all passengers on board. This event shook Iran and prompted a strong international reaction, with many world leaders expressing condolences and calling for a thorough investigation.

Conclusions

The situation in financial markets remains positive in the equity sector, with the medium- to long-term trend still intact. In contrast, the bond market presents a more complex situation, aggravated in recent months by the significant change in monetary policies expected from central banks. In the coming months, high volatility is expected in this sector, which is strongly influenced by future inflation data. In this scenario, the dollar is expected to maintain a position of relative strength against major currencies, while gold is expected to continue to benefit from strong demand, both from central banks and retail investors.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Industrials

- Information Technology

- Communication services

Market data (data as of 31.05.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.