Index

Markets

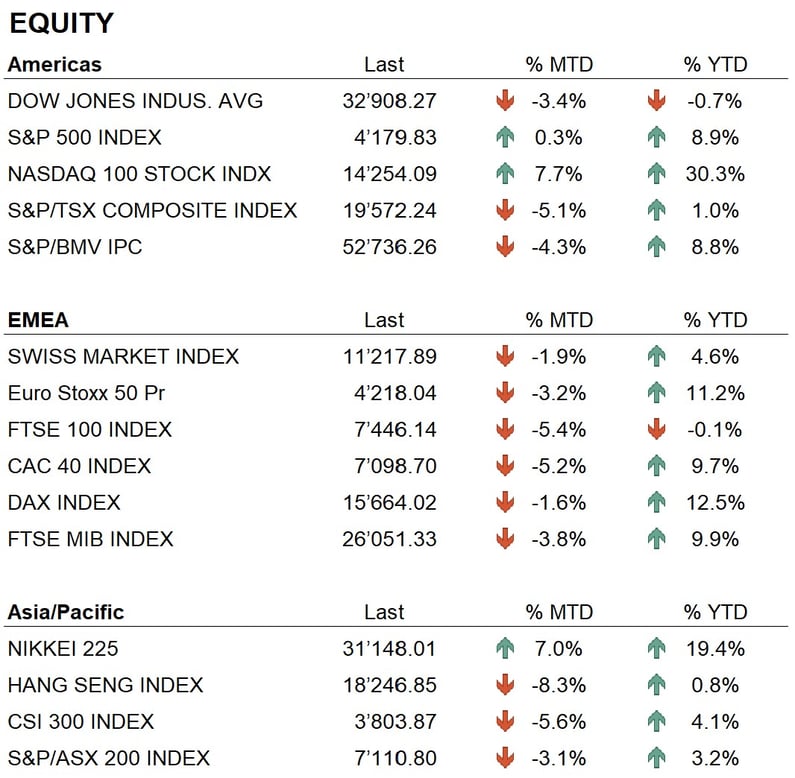

The month of May this year turned out to be a month of transition, and the old stock market saying "sell in May and go away" was not so effective. In fact, the markets end the month with mixed performances: in the United States, the Dow Jones index records a monthly performance of about -4 percent, the SP500 index ends the month unchanged, while the Nasdaq Composite achieves a positive performance of about 6 percent, driven by large technology stocks that reported excellent quarterly results. In Europe, the Eurostoxx 50 registers a negative performance of about 3.4 percent after touching the year's highs, while the DAX closes slightly negative after briefly approaching its all-time highs. In Asia, it is worth noting the excellent performance of the Nikkei, which closes the month up about 7 percent, while Chinese markets are down an average of 4 percent. During the month, there were no notable events to report in the equity markets other than the aforementioned excellent performance of the big players in the technology sector, which attracted significant money flows thanks to recent developments in artificial intelligence. In particular, Nvidia's stock stood out after a very positive quarter and excellent prospects for the future, recording a significant performance. In fact, since the beginning of the year, the stock has gained 160 percent.

In the bond markets, we have seen a rise in dollar interest rates across the curve. The 10-year closes the month with an increase of 0.30 percent and a yield around 3.80 percent, while the shorter two-year maturity sees an increase of about 50 basis points to around 4.50 percent. The cause of these rises has been the issue of the U.S. debt ceiling. In fact, these days, the debt has reached the maximum allowed and it becomes necessary to revise the ceiling itself, which must be agreed upon between Democrats and Republicans. Thus, the issue moves from the field of economics to the field of politics, where the logics at play are clearly different, especially in view of next year's presidential elections. Similar situations have occurred before (2011-2013) and in both cases the ceiling was raised after intense negotiations that, however, led to the first downgrade of U.S. debt by one level by S&P. This year, so far, only the rating agency Fitch has announced that it has placed U.S. debt with a negative outlook. Reaching the debt ceiling would initially result in a halt to a number of payments the state must make, starting with salaries of state employees and suppliers, which would have a significant impact on the U.S. economy.

In the currency market, the dollar's rise in interest rates has led to its appreciation against other major currencies. At the end of the month, the dollar stood at about 1.07 against the euro, gaining about 3 percent, while the Swiss franc strengthened against the euro, closing the month at about 0.97 with a gain of about 1.5 percent. The dollar's strength had an impact on the price of gold, which during the month reached near all-time highs around $2'060 an ounce, but closes the month around $1'950.

Economy

On the economic front, the month of May brought no big surprises in terms of data released. The U.S. quarterly GDP figure was positive, with growth of 1.3 percent, slightly higher than expectations, which were 1.1 percent. In Europe, on the other hand, there was the German quarterly GDP figure, which decreased by 0.3 percent, compared to expectations of a growth rate of 0 percent. This figure marked the beginning of a recession in Germany, considering that the figure had also been negative in the previous quarter. We remain awaiting the release of inflation data in both the United States and Europe in the coming days.

Regarding central banks, earlier this month the Federal Reserve raised interest rates by 0.25 percent, bringing the benchmark rate to 5.25 percent, while the ECB increased the benchmark rate by 0.25 percent to 3.25 percent. After this latest decision, the U.S. Federal Reserve signaled a possible pause in the rate hike cycle, at least for the next few months. On the other hand, the European Central Bank currently gives signs of a further rate increase at its next meeting in mid-June.

Geopolitics

The international geopolitical situation showed no improvement during the month of May. The conflict between Russia and Ukraine continues unabated, and the only news concerns mediation by the Chinese. In recent days there has also been talk of mediation by the Vatican, which seems to have found a willingness to negotiate on the part of the Russians.

During the month there was also an important meeting of the G7 countries in Japan, which in its final communiqué emphasized some crucial points, such as support for Ukraine and condemnation of Russian aggression. In addition, the danger posed by China to the Asian region was highlighted. Regarding the economy, the big seven stressed that uncertainty is very high and that economic growth in the near future is at risk.

Conclusions

Financial markets remain in a positive medium-term trend, supported mainly by the technology sectors. Major stocks such as Microsoft, Google, Amazon, etc. reported positive quarterly data and announced major developments in the field of artificial intelligence. Developments in this area have opened up new horizons in the technology sector, and major players are focusing considerable resources in this direction.

However, the most important game remains that of central banks in the fight against inflation. After months of very aggressive monetary policy, the Federal Reserve is signaling a pause, while the ECB will continue to raise rates in small steps in the coming months. That said, in the interest rate world, we will be navigating by sight in the coming months, and investment decisions will be made based on the economic growth and inflation data that are published from time to time.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Consumer Discretionary

- Industrials

- Information Technology

Market data (data as of 1.06.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.