Index

Markets

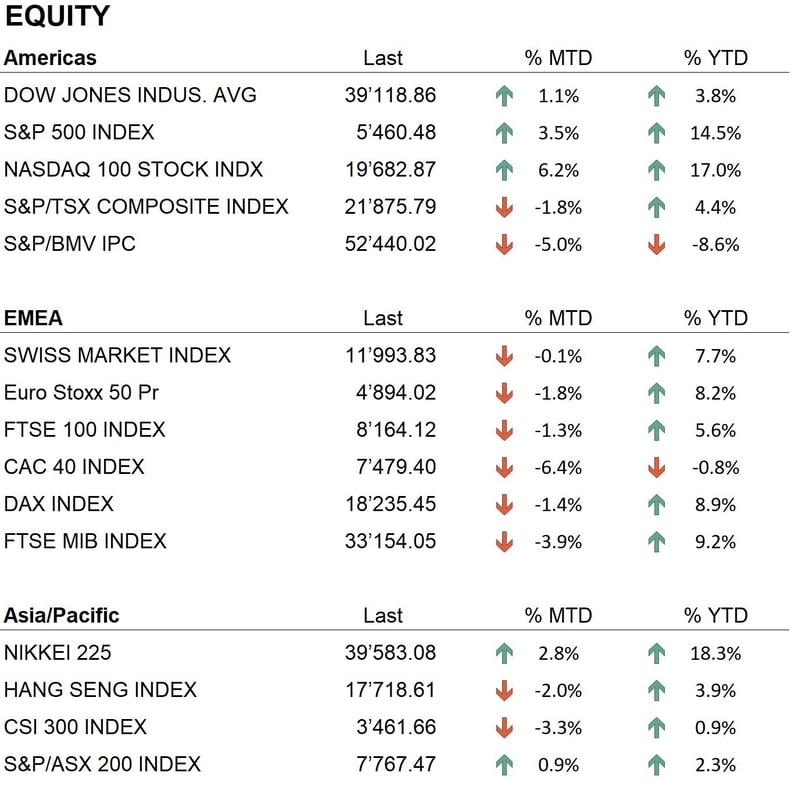

The month of June showed uncertain trends in the prices of the world's major stock exchanges. Europe showed mixed trends, while U.S. markets proved stronger. Since the beginning of the month (MTD), U.S. indices have performed positively, driven by big cap tech: the Dow Jones rose 1.4%, the S&P 500 3.4%, and the Nasdaq 100 5.8%. In Europe, European elections negatively affected markets. The Eurostoxx 50 fell 2.2% and the CAC 40 fell 6.3%. In contrast, other European markets showed signs of strength: the DAX rose 1.7% and the SMI closed up 6.5%. In Asia, markets showed mixed trends. The Nikkei performed positively, up 1.7%, while in China, the Hang Seng index saw a slight decline of 0.3% and the CSI 300 fell significantly by 4%.

The bond sector saw moderate movements. Analysts reacted positively to better-than-expected inflation data in the United States. However, 10-year Treasury yields, which were 4.5% at the beginning of the month, fell to 4.4%, reflecting an adjustment in investors' expectations of future Fed moves. The Federal Reserve kept interest rates unchanged at its June 12, 2024 meeting, leaving the rate at 5.5%. Implied future rates indicate 5.25% in September and 4.99% in December 2024, suggesting that the market expects two rate cuts by the end of the year. In Europe, inflation was less aggressive than expected, with the European Central Bank keeping rates unchanged. In Switzerland, the Swiss National Bank (SNB) lowered its benchmark rate. As a result, CHF-denominated bonds gained ground.

As for precious metals, gold held steady, remaining virtually unchanged from last month's record levels. Silver fluctuated, remaining above $29 an ounce, supported by expectations of a Fed rate cut. However, uncertainties about demand in China, the largest consumer of silver, put pressure on prices, with China's manufacturing PMI index contracting for the second consecutive month.

In the cryptocurrency market, June saw a significant correction in prices. Bitcoin and Ethereum posted significant losses, reflecting negative sentiment among investors.

Economy

During June 2024, the release of inflation data in the United States indicated a slowdown. The consumer price index (CPI) monthly basis remained unchanged, while annual inflation decreased to 3.3%, slightly lower than the previous month. This positively surprised the markets, which reacted with moderate optimism, showing a positive investor perception of the economy's handling of inflation. As for economic growth, annual GDP figures in the U.S. and Eurozone were released, which confirmed analysts' expectations at 1.4% and 0.4%, respectively.

Geopolitics

Regarding global tensions, both in Ukraine with Russia and in Israel with Hamas, there is no diplomatic improvement. In Ukraine, fighting continues in the Kharkiv and Donetsk regions, causing evacuations and heavy human and material losses. Similarly, in Israel, conflicts with Hamas persist, with frequent rocket attacks and military operations showing no signs of imminent peaceful resolution.

The legislative elections in France, called by President Emmanuel Macron after his party's defeat in the European elections, resulted in an uncertain outcome. Marine Le Pen won strong support, while Macron's coalition showed weakness, increasing political uncertainty and negatively affecting French financial markets. The European Parliament elections saw an increase in support for populist and far-right parties, further complicating EU policy in the coming years. The final votes to determine the composition of the French National Assembly will be held on July 7, 2024.

The first televised debate between President Joe Biden and former President Donald Trump was held on June 27, 2024 at CNN studios in Atlanta. The debate, which featured new rules to ensure a more orderly discussion, saw both candidates confront each other on several key issues. Biden's performance during the debate was met with widespread criticism, fueling speculation about his possible withdrawal from the electoral race. After the debate, however, the president indicated that he has no plans to withdraw. Should Biden withdraw, possible candidates to take his place would include Vice President Kamala Harris, California Governor Gavin Newsom, and Michigan Governor Gretchen Whitmer.

Conclusions

In June 2024, financial markets showed mixed dynamics. While the equity sector maintained and consolidated a positive medium- to long-term trend, the bond market continued to face difficulties due to uncertain monetary policies and expectations of future inflation data. Recent elections in Europe and France added further political doubts, affecting financial markets. The U.S. dollar maintained a position of relative strength against major currencies, while the Swiss franc showed significant strength, solidifying its reputation as a safe haven currency. In the commodities environment, gold continued to benefit from strong demand from central banks and retail investors, maintaining its stable position in the market.

In terms of management, we maintain an overweight position on the equity sector and precious metals.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Industrials

- Information Technology

- Communication services

Market data (data as of 28.06.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.