Index

Markets

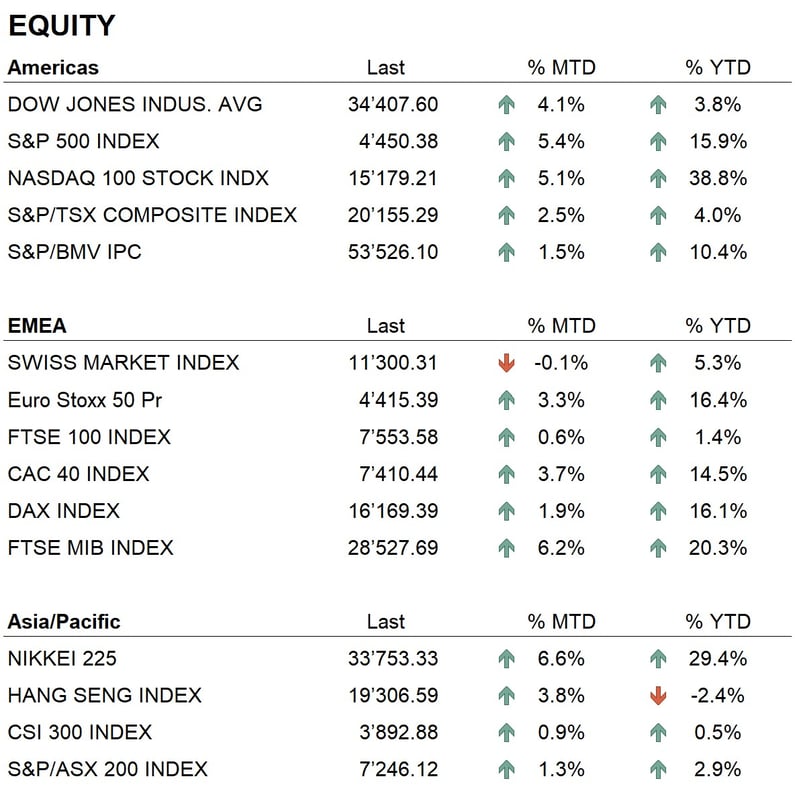

The month of June closes positive on all major stock markets. Thus, we saw a continuation of the upward trend that began during the month of May, which led all listings to perform strongly in this first half of 2023. The two main U.S. listings, S&P500 and Nasdaq, close the month at +5.4% and 5.1%, respectively, while in Europe the indices close on a positive note, with the Eurostoxx 50 at + 3.3% and the Dax at 1.9% The latter is close to all-time highs. In Asia, the best performances were recorded by the Nikkei 225, which closes the month with an increase of 6.55%, while the Chinese indices average around 1% growth.

June thus concludes a positive six-month period for global equity markets, which have shown clear signs of recovery since the 2022 downturn. The performance of the major U.S. indices since the beginning of the year is 15.9% for the S&P500 and as high as 38.7% for the Nasdaq, which is recording one of the best six-month periods in its history. This result is due to the excellent performance of technology stocks, driven upward by the new investment theme much discussed worldwide, artificial intelligence. In Europe, the major indexes end the six-month period in decidedly positive territory, with the Eurostoxx 50 up 16%, the Dax up 16%, the Ftse Mib up 19%, and the SMI up 5%.

On the rates and global bond markets front, the month of June saw little movement. Central banks continued on the path of tightening monetary policies, especially in Europe, where the ECB raised interest rates by 0.25% and the Swiss National Bank by 0.50%. In the United States, on the other hand, the Federal Reserve, at its June meeting, did not change interest rates, but hinted that further action might be taken at future meetings if inflationary tensions do not diminish noticeably. The trend in rates thus showed a slight increase in the short end of the curve, while in the long end the values remained almost unchanged. This movement has led to a further inversion of the rate curve, which is particularly evident in the U.S. government bond market, where the negative spread between two-year bonds (4.70%) and ten-year bonds (3.70%) is at an all-time low. This situation highlights the negative view the market has on future global economic growth; in fact, many traders expect a recession in the next six months, including in the United States.

On the currency market, there have been no significant movements. The quotations of the euro against the dollar and the Swiss franc remained on a sideways trend. As for precious metals, we saw a slight decline in gold, after last month's good performance, when the yellow metal had touched an all-time high against the dollar. As far as cryptocurrencies are concerned, it is worth noting the excellent performance of Bitcoin, which closes the month with an increase of about 12%, reaching $30,000.

Economy

In the economic field, there have been no publications of particularly relevant data regarding growth. Therefore, we remain waiting for data for the second quarter of 2023, which will be published during July. During the month, inflation data for May were published in both Europe and the United States. These data show that price tensions continue to be high. In fact, at the European level, annual core inflation is around 5.5%, while in the United States it is around 4.7%.

Geopolitics

On the international geopolitical front, the month of June was marked by events in Russia in recent days, where a military uprising by the mercenary group Wagner brought the country to the brink of civil war. This historic event highlighted the fragility of the system of government in Russia. The figure of Putin has lost much of his power and credibility within the country. Now the situation has calmed down, but it is unclear whether this will have any impact on Russian domestic politics in the medium to long term. From the perspective of the markets, these events have had no impact at the moment.

Conclusions

The trend in major world equity markets remains positive, but in the short term we expect slight downturns and consolidations after the excellent performance since the beginning of the year. From a seasonality perspective, we now enter the third quarter, which statistically is not particularly profitable. The favored sectors remain those of technology, which, as mentioned earlier, are supported by the incredible developments in the field of artificial intelligence. This investment theme will be a major one in the future, and we are only now seeing the first impacts of the use of artificial intelligence in work activities and everyday life. In the bond market, we do not expect major changes in either rates or credit spreads. That said, our investment policy for the foresee no significant changes in portfolio allocations in the near future, but we do not rule out possible reductions in risk exposure if trends show signs of weakness.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Consumer Discretionary

- Industrials

- Information Technology

Market data (data as of 30.06.2023)

Event calendar

Legend

| CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.