Index

Markets

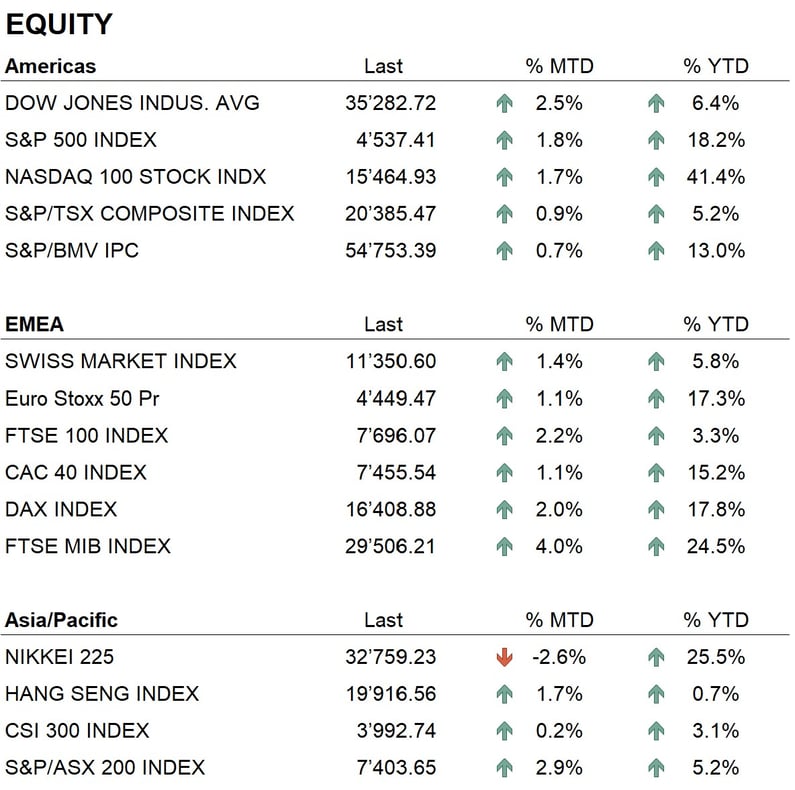

July closes in slightly positive territory on the world's major stock markets. The U.S. S&P500 and Nasdaq indices close at about +2%, while the Dow Jones at +2.5%. In Europe, the month closes slightly more modestly, but still in positive territory. After an attractive first half of 2023 performance, the beginning of the second half saw a consolidation of the market with some profit-taking in the sectors that had performed best, such as technology. These days the publication of quarterly results, covering the April-June period, has begun, and so far the data published is positive, with results mostly exceeding analysts' expectations. Only a few tech stocks, such as Netflix, have reported numbers below expectations, and profit-taking has begun as a result.

On the bond front, the month of July was rather up and down, but in the end it closed with medium- and long-term rate levels almost unchanged. Some inflation data released during the month showed a slight decline in both the United States and Europe. However, inflation levels still remain very high, well above the ideal level of 2 percent indicated by the central banks, namely the Federal Reserve and the European Central Bank. During the month, we had several comments from central bankers regarding inflation. On the American side, there is a more wait-and-see attitude after a very intense series of rate hikes, while the European Central Bank still showed some aggressiveness and announced that there will be more rate hikes in the future.

In the currency sphere, in the past month we have seen a very volatile movement in the U.S. dollar. In the first part of the month, it showed obvious weakness against all the major world currencies, touching the lows of the past 12 months. In the second half of the month, the dollar then recovered some of the lost ground. At this stage, we also saw a recovery in precious metals prices, with gold returning to close to $2,000 per ounce.

Economy

A number of economic data were released during July, the most notable of which included inflation trends. In the United States, the level of headline inflation fell to 3%, while core inflation, which excludes more volatile items such as food and energy, fell to 4.8% (previous figure 5.4%). Inflation is also falling in Europe, but it remains much higher than in the United States: the latest survey gives us a level of 5.5% on both headline and core inflation. It is noteworthy that in some countries, such as Germany, inflation still remains at very high levels; the latest published figure records headline inflation at 6.8%.

The Federal Reserve, at its July 26 meeting, raised the benchmark rate by 0.25% to 5.5% -the highest level in 22 years. In the press conference following the decision, U.S. central bank governor Powell did not give any specifics on upcoming decisions, but he was very tentative, saying that the central bank will act based on economic data that will be published.

The European Central Bank, at its July 27 meeting, decided to raise rates by 0.25%, bringing the benchmark rate to 4.25%. After the meeting, the signal was for further hikes in the coming months. The ECB is determined to bring the inflation level to 2%.

Regarding economic growth, a relevant figure released during July was China's. Expectations were for growth in the second quarter of 7.1%, but the figure found showed a more modest growth, at 6.3%. China, the world's second largest economy, is showing signs of slowing down in its growth trend, and the main cause remains the real estate sector, which has been in a slump for some time. In the United States, economic growth in the second quarter is expected to pick up, and the unemployment level is at an all-time low.

Geopolitics

As of July, the war conflict between Russia and Ukraine has seen no developments that could lead to a resolution of the situation in the short term. The two conflicting forces have reached a stalemate, with neither able to impose itself on the other. However, diplomatic efforts continue to find a solution that can bring peace to these lands.

In the same month, there was a slight improvement in relations between China and the United States. At the diplomatic level, U.S. Treasury Secretary Janet Yellen visited China and stated that the relationship between the two nations as a whole now has a stronger foundation

Conclusions

Trends in the world's major stock markets continue to be positive. After the close of the first half of the year, we saw some profit-taking and a slight decline in the indexes, but they have recovered quickly reaching new relative highs. At the moment, the leading sectors remain technology, industrials and consumption in the United States, while in Europe, in addition to industrials and consumption, we also have financials.

The monetary policies of central banks seem to have reached a crossroads, with the Fed ending its phase of rate hikes and the ECB still in the midst of tightening. In the bond market, with inverted yield curves (short-term rates higher than long-term rates), we continue to bet on a recessionary scenario in Europe as early as 2023 and in the US in 2024.

Our investment policies currently maintain a neutral weighting on the equity side, while on the bond side, we remain invested in the middle part of the curve, between 2 and 5 years.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Industrials

- Consumer Discretionary

Market data (data as of 27.07.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.