Index

Markets

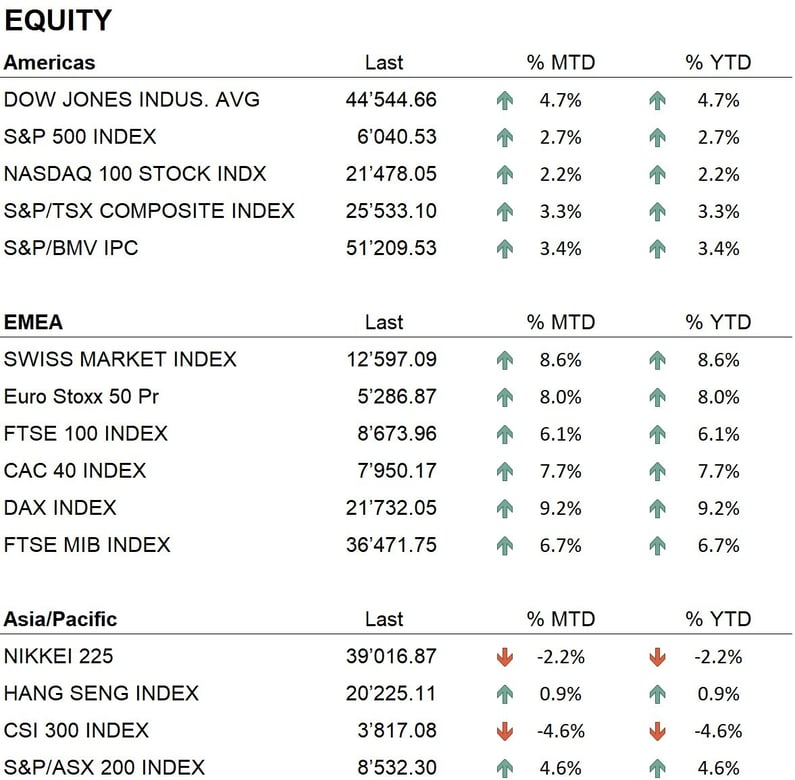

The year 2025 has started on a positive note, aiding the recovery of December losses for several listings, which have moved back closer to their November highs. Some markets posted significant gains, especially in Europe, where indexes such as the SMI and Eurostoxx 50 have already outperformed the entire 2024.

In the United States, the Dow Jones closed the month at +4.7%, the S&P 500 at +2.7%, and the Nasdaq 100 at +2.2%. In Europe, the Eurostoxx 50 gained 8.0%, the FTSE 100 6.1%, the DAX 9.2%, the CAC 40 7.7%, and the FTSE MIB 6.7%. In Asia, the Nikkei posted -2.2%, while the Hang Seng closed the month at +0.9%.

Bond markets saw a rise in yields in the first half of the month, followed by a correction after central bank decisions. The yield on the 10-year Treasury touched 4.8% before retracing to 4.54%, while government bond yields in Europe followed a similar trend, declining after the ECB announcement.

Inflation data in Europe and the U.S. showed no signs of further decline, with pressures persisting in the U.S., partly due to uncertainty over tariffs imposed by the Trump administration. In response to the weaker European economy, the ECB cut rates by 25 basis points in late January, while the Fed kept monetary policy unchanged.

Gold reached new all-time highs, closing near $2'800 USD/ounce, supported by growing demand for safe-haven assets amid geopolitical uncertainty and concerns about global growth, accentuated by Trump's tariff plans.

After surpassing the $100'000 mark at the end of 2024, Bitcoin began the year on an uptrend, reaching a high of $106'146 on Jan. 16, supported by capital inflows to spot ETFs on BTC and positive sentiment. In the second half of the month, it underwent a correction, closing January at $102'110. XRP, the fourth-largest cryptocurrency by capitalization, outperformed the market by 44.9%, driven by expectations of a possible ETF and increased adoption in international payments. With its fast and efficient transaction technology, XRP is taking a key role in global payments. Institutional interest and an improved regulatory environment have reinforced the positive trend.

Economy

Major central banks made key monetary policy decisions in January, reflecting the different economic conditions between the United States and Europe.

The Federal Reserve, at its Jan. 29 meeting, kept rates in the 4.25% to 4.50% range, reiterating the need to gather more data before any changes are made. Jerome Powell stressed that although inflation in the United States is showing signs of cooling, the Fed intends to maintain a cautious approach to avoid premature easing. Markets, which were pricing in more aggressive cuts in the first half of the year, have scaled back expectations, with Fed Funds futures indicating more uncertainty about the timing of the first rate cut.

In Europe, the ECB announced on Jan. 30 a 25 basis point cut, bringing the deposit rate to 2.75%, to counter slowing growth in the Eurozone. In particular, Germany is suffering from weak global demand and a slump in manufacturing, while France and Italy are experiencing marginal growth. Inflation has stabilized around 2%, but the ECB is aiming to stimulate the economy without compromising progress on price restraint.

The divergence between the Fed and ECB highlights the different economic conditions. While the Fed awaits further confirmation before a possible cut, the ECB has chosen to act preemptively. The impact of these decisions will depend on the evolution of macro data in the coming months, with a focus on the labor market in the United States and the recovery of demand in Europe.

Geopolitics

On Jan. 20, 2025, Donald Trump was sworn in as the 47th president of the United States, immediately launching an aggressive geopolitical agenda. He reopened the Greenland dossier, reiterating his interest in acquiring the territory and threatening economic and military countermeasures. He also proposed regaining control of the Panama Canal, triggering strong international reactions. On the migration front, he authorized a detention center at Guantanamo and forced Colombia to accept flights with deported migrants in exchange for the suspension of new tariffs. His foreign policy is moving toward tighter protectionism and increased pressure on Europe and China.

On Jan. 19, 2025, Israel and Hamas agreed to a six-week truce brokered by the United States, Egypt, and Qatar. The agreement calls for the gradual release of 33 Israeli hostages in exchange for hundreds of Palestinian prisoners. Despite some violations, the truce has allowed humanitarian aid into Gaza and the return of thousands of Palestinians to the north of the Strip. However, the situation remains fragile, with persistent tensions and difficulties in securing lasting peace.

In the conflict in Ukraine, Trump's election introduced new diplomatic dynamics. He has expressed his intention to negotiate directly with Russia to end hostilities, raising concerns in Europe about possible deals that could exclude European and Ukrainian interests. Meanwhile, Russia has stepped up attacks on Ukrainian infrastructure as Ukraine seeks military support from Western allies. The prospect of scaling back U.S. support could leave Europe in a more vulnerable position in managing the conflict.

Conclusions

The year 2025 began with a major rebound in equity markets, accompanied by significant movements in bond yields and major asset classes. Diverging monetary policies and geopolitical uncertainties remain key factors, making close monitoring of macroeconomic developments in the coming months essential.

We maintain a slight overweight in equities and have returned bonds to a neutral level, reducing liquidity. Our focus remains on strategic assets such as gold, which continues to offer protection in an environment of economic and geopolitical uncertainty. We also favor exposure to the Information Technology, Financials, and Consumer Discretionary sectors.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Financials

- Consumer discretionary

Market data (data as of 31.01.2025)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.