Index

Markets

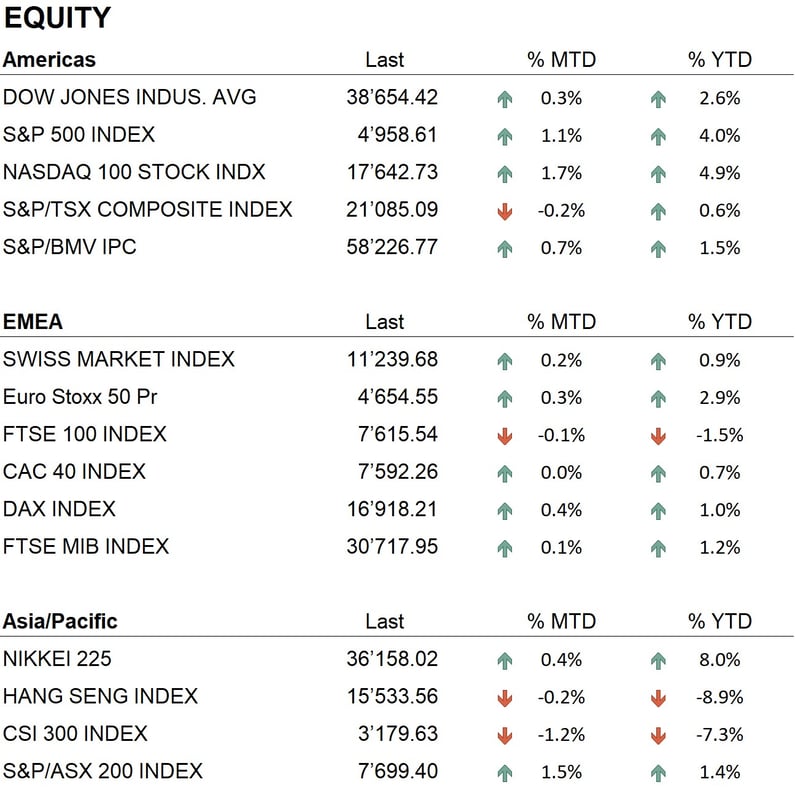

2024 has seen a fairly mixed start to the year in financial markets. The world's major stock exchanges have performed negatively for much of the month, only recovering in the final stages and posting year-to-date performances ranging from 2 percent to 3 percent. In Japan, the Nikkei posted a strong performance of about 8 percent, while the Chinese markets continued in their downtrend. In fact, Hong Kong fell by about 6 percent, and the Shenzhen index by more than 10 percent, hitting its lowest level in four years. In China, the economic situation remains very tense: the real estate crisis has caused further problems for the country's economy. In this regard, the Chinese government has allocated an aid intervention of about $280 billion, which, however, has not had much of a positive effect on stock market performance. Returning to Japan's Nikkei 225 index, the positive news is that with this performance, the index has reached levels not seen in more than 30 years, that is, since the highs reached in the late 1980s and early 1990s following the Japanese real estate bubble.

Bond markets saw an upward trend in rates, both in Europe and the United States. After a sudden descent that began in October and ended in late December, rates began a rebound phase, following some economic data regarding inflation and comments by central bankers, both American and European, that slightly cooled market expectations of possible rate cuts as early as the spring. As a result, the rate hike has hurt bond market prices, which have been negative across the board since the beginning of the year.

In the currency sphere, the rate hike has favored the performance of the dollar, which has strengthened slightly against major currencies. In Europe, the Swiss franc hit new highs against the euro. Gold's performance during the month was sideways, with quotations showing an interesting consolidation phase above $2,000 an ounce, not far from all-time highs. In the cryptocurrency sector, the start of the year was interesting: after a long time, the US SEC authorized the issuance of ETFs linked directly to Bitcoin. This development brought the cryptocurrency's quotations to close to $50,000, levels not seen in about two years. This event represents a major breakthrough for the cryptocurrency market, as it gives a wide audience direct and easy access to the Bitcoin market.

Economy

Economic data released during January gave a somewhat mixed picture of the performance of various economies. In the U.S., the latest GDP trend data released showed that the economy is continuing its growth at a strong pace, even going beyond analysts' expectations. In fact, U.S. GDP showed last quarter's annualized growth of 3 percent, while analysts' expectations were at 2 percent. In Europe, the situation is not so rosy, and data show a stalled economy, with Germany in recession. In Asia, as mentioned earlier, China's growth is slowing, and the country is facing the consequences of the bursting of the real estate bubble that is hurting many sectors of the country's economic life.

Geopolitics

During the month of January, on the international geopolitical front, we saw deteriorations in both the conflict between Russia and Ukraine and the situation in the Middle East. On the first front, the Russians have increased their action and consolidated their positions, while the Ukrainians are having several difficulties in their offensive. In recent days, there have been rumors of possible negotiations regarding a lasting truce. In the Middle East, the situation between Israel and Hamas remains very tense, and here, too, there is an ongoing mediation effort that should lead to a long truce. Also in the Middle East, tensions between Iran and the United States are increasing by the day. In the Red Sea, assaults on Western cargo ships by Yemeni groups, supported by Iran, are causing several problems for trade transport between Asia and Europe. For this reason, the United States and its allies are conducting crackdowns in Yemen against these groups. Meanwhile, several shipping companies are avoiding the Red Sea passage and thus the Suez Canal, and are forced to circumnavigate Africa to reach Europe, resulting in increased shipping time and costs. Also in the region, a few days ago, groups backed by Iran attacked a U.S. base on the border between Jordan and Syria, resulting in the deaths of three U.S. soldiers. The Middle East is currently the most contentious spot on the planet, the conflict seems to be spreading rapidly, and a direct confrontation between the U.S. and Iran seems increasingly likely.

Conclusions

The year 2024 begins with fluctuating trends, yet the stock markets continue to exhibit a positive outlook for the medium to long term, bolstered by strong economic data, particularly from the United States. We are currently in the midst of publishing quarterly reports, which could provide us with additional insights to assess the economic climate. Interest rates, meanwhile, are in a neutral phase, with central banks' monetary policies on hold as they await further inflation data. Should this data prove positive, it could trigger a phase of rate reductions. On the currency front, the dollar remains robust at this stage, and the Swiss franc further solidifies its strength. Gold maintains its long-term upward trend, and cryptocurrencies have shown noteworthy recovery. From a management perspective, we consistently favor an overweight position in the equity sector, particularly favoring sectors such as Information Technology, Financials, and Healthcare. Regarding the bond market, we prefer to adopt a neutral stance while we await additional data and insights on inflation and the monetary policies of central banks.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Information Technology

- Health Care

Market data (data as of 02.02.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.