Index

Markets

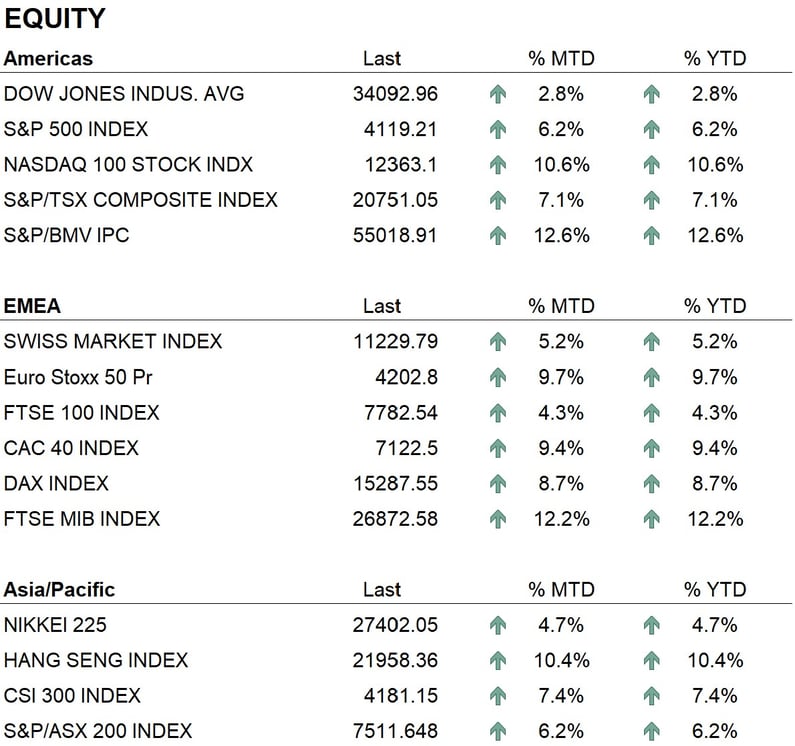

The year 2023 has started positively for financial markets with world stock exchanges posting gains of more than 10%. In the U.S. the S&P500 index performed 5% while the Nasdaq performed 10%, in Europe the performance of the Eurostoxx index was over 10%, and in Asia we have the Nikkei rising 5% and China going over 10%. Some sectors that were penalized in 2022, such as communications and IT, have seen a recovery with the FAANG index (Facebook, Amazon, Apple, Netflix, Google) rising over 20%. The energy and financial sectors remain consistently attractive.

On the bond side we have seen a decline in both euro and dollar rates and a tightening of credit spreads. This has led to a recovery in bond valuations, which in 2022 had experienced one of the worst years in their history. Currently, the level of yield offered by the bond market in dollars and euros has returned to acceptable levels on average. The large amount of negative-yielding bonds, which had reached $18 trillion, has completely zeroed out in recent months, and thus, after a few years, we have positive-yielding bonds again all over the world.

Economy

On the economic front, we saw the first data on 2022 GDP. In the U.S., growth exceeded expectations, rising 2.9 % against expectations of 2.6 %. In Europe, we only have data from Germany showing an increase of 1.1 % against expectations of 1.3 %. Inflation figures were also recently published: in the United States, the annual increase in consumer prices was 6.5 %, while in Europe, harmonized inflation was 9.2 % overall and 5.2 % for core inflation, which excludes food and energy. Having said that, the picture before us at the beginning of this year is one of a U.S. economy continuing to grow at an attractive pace while we see a European economy slowing sharply with some areas possibly entering recession as early as this quarter. Even from an inflation perspective we have two different pictures with U.S. inflation being pushed up by the strength of demand for goods while European inflation is being pushed up mainly by energy costs. The year 2023 will see a slowdown in economic growth worldwide in fact even the International Monetary Fund recently revised its growth estimates lowering them from 2.1 % to 1.9 %, for the G8 countries the expected growth in this year will be a timid 0.2 % while the expected inflation also in the G8 countries will be 4.3 %. In the coming days there will be two important meetings of central banks, on February 1 The Fed will tell us its decisions on interest rates and the next day it will be the turn of the ECB to communicate monetary policy decisions. The decisions are awaited with great interest by traders in the markets as they will go a long way in influencing the future performance of financial markets.

Geopolitics

The international geopolitical situation continues to be affected by the unfolding conflict between Russia and Ukraine, where there are no signs of easing. On the Middle Eastern front, internal tensions continue to rise in Iran where popular protests are getting louder as well as repression by the police and military, while on the external front Iran's level of confrontation especially with Israel is increasing exponentially and it is just in the last few days the news, that some drones, probably Israeli, would have bombed some Iranian sites. From the point of view of the major world balances, a very important bloc is forming with the Brics+ countries namely Brazil, Russia, India, China, South Africa, Singapore and the United Arab Emirates, which are organizing a cross-border payments system as an alternative to the Swift system and are also considering the creation of a single currency that should replace the dollar in trade. This new currency could be named R5 after the currencies of the 5 Brics countries (Real, Ruble, Rupee, Renminbi, Rand) and would be an important step in the "de-dollarization" process pursued by the above countries.

Conclusions

Our current approach leads us to look at the short to medium term because of the volatility dictated by the lack of a clear view on global economic development. We are confronted with a reality where a slowdown in inflation and consequent easing of monetary policies is expected, with the knowledge that other exogenous factors could reignite inflation itself. As of yet, it is still unclear whether we will be confronted with a so-called soft landing or hard landing. The trend in equity markets is positive, and in recent weeks some important trend signals have been triggered in both U.S. and European markets. As for the bond segment, the latter has recovered a lot of ground and here too the outlook is positive again over the same time frame, then the outlook on metals such as gold and silver remain interesting. In our opinion the most important choices in 2023 will be on sectors; identifying and investing on those driving the current economy will be the winning choice for this year. Having said that as far as our managements are concerned, we remain with an overweight on the equity side while on the bond side we continue to invest in investment grade issuers and the two- to five-year segment of the curve. In particular, on the bond segment we believe that we should not see a skewed situation like in 2022 where equities and bonds had an almost linear correlation.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Energy

- Financials

- Materials

Market data (data as of 31.01.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.