Index

Markets

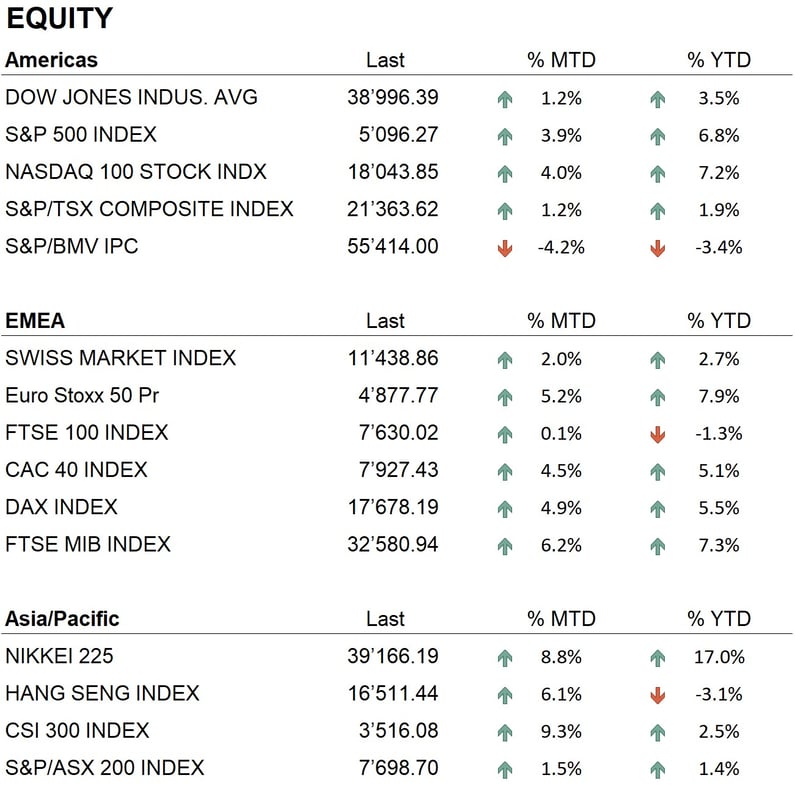

The month of February 2024 was positive in global stock markets, showing outstanding performance, particularly in the Asian region. U.S. indices ended the month up: the Dow Jones rose by 2.5 percent, the S&P 500 by 5 percent, and the Nasdaq by 6 percent, the latter particularly boosted by the excellent quarterly reports of some companies, such as Nvidia, which reached a new all-time high. Similarly, in Europe, indices showed excellent performance, with the Eurostoxx 50 up 5 percent and the Eurostoxx 600 up 2.5 percent. In Asia, markets achieved remarkable results: the Nikkei saw an increase of 8.5 percent, again touching the 40,000 level, a milestone last reached in the late 1980s and early 1990s, some 34 years ago. China also showed signs of recovery, with Hong Kong rising 8 percent, improving its performance since the beginning of the year to -2 percent.

As for bond markets, the balance was not as positive: during February, bond yields, both government and corporate, hit annual highs. The 10-year U.S. government bond, which had a yield of 3.90 percent at the beginning of the month, closed with a yield of about 4.30 percent. In Europe, the yield on the 10-year German Bund rose from 2.10 percent at the beginning of the month to about 2.40 percent. The rise in yields thus penalized the entire bond sector, with negative performance since the beginning of the year ranging from -1% to -3%, adversely affected by the U.S. inflation figure in the middle of the month, which turned out higher than expected.

In the currency field, the month passed quietly: the dollar remained stable against the euro, but strengthened against the Swiss franc, causing the latter to weaken slightly against the euro. Precious metals ended the month without significant changes. Noteworthy, however, was the positive performance in the world of cryptocurrencies, with Bitcoin recording a monthly increase of more than 20 percent and Ethereum rising more than 34 percent, returning to its highest level in two years.

Economy

The month saw the release of important economic data on GDP growth and inflation. The European GDP growth figure for the fourth quarter indicated stagnation, rising by 0%, while the German GDP situation was even more worrisome, registering a 0.3% decline and signaling Germany's entry into a recessionary phase. In the United States, the economy showed 3.3% year-on-year growth in the fourth quarter of 2023. Inflation presents a slightly better picture in Europe at 2.8% year-on-year, while in the United States the figure stood at 3.9%, below analysts' expectations of 3.7%. These data directly influence the monetary policies of the Federal Reserve and the European Central Bank, which are being forced to postpone the first steps toward monetary policy easing.

Geopolitics

The international geopolitical situation in February remained largely stable in the major conflict theaters in the hemisphere. The confrontation between Russia and Ukraine saw some victories for the Russian military, but the overall situation is one of stalemate, with no clear prevailing of one side over the other, suggesting that the conflict is still far from a final settlement. Equally tense remains the frontline between Israel and Hamas, with an intensification of Israeli military operations in the Gaza Strip. Despite efforts, particularly by the United States, there has been no conclusion to the conflict, hoping at least for a ceasefire that would facilitate the arrival of humanitarian aid to the affected populations. The region has also seen an increase in raids by Yemeni terrorist groups against cargo ships, especially British and American ones, crossing the Red Sea bound for the Suez Canal. As a result, an international task force, with the participation of some European countries, has been established to counter the actions of the Houthis, supported by Iran.

Conclusions

The upward trend of stock markets is maintained, with the S&P 500 and Nasdaq setting new all-time highs. Quarterly reports released so far confirm the strength of the U.S. economy, with the technology sector in particular showing vigorous growth, driven by the advancement of artificial intelligence. The bond market, however, remains uncertain, highly dependent on central banks' monetary policy expectations and future inflation data. In the currency sector, the dollar retains a neutral stance against major currencies, while cryptocurrencies maintain a decidedly positive trend.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Industrials

- Information Technology

- Communication services

Market data (data as of 29.02.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.