Index

Markets

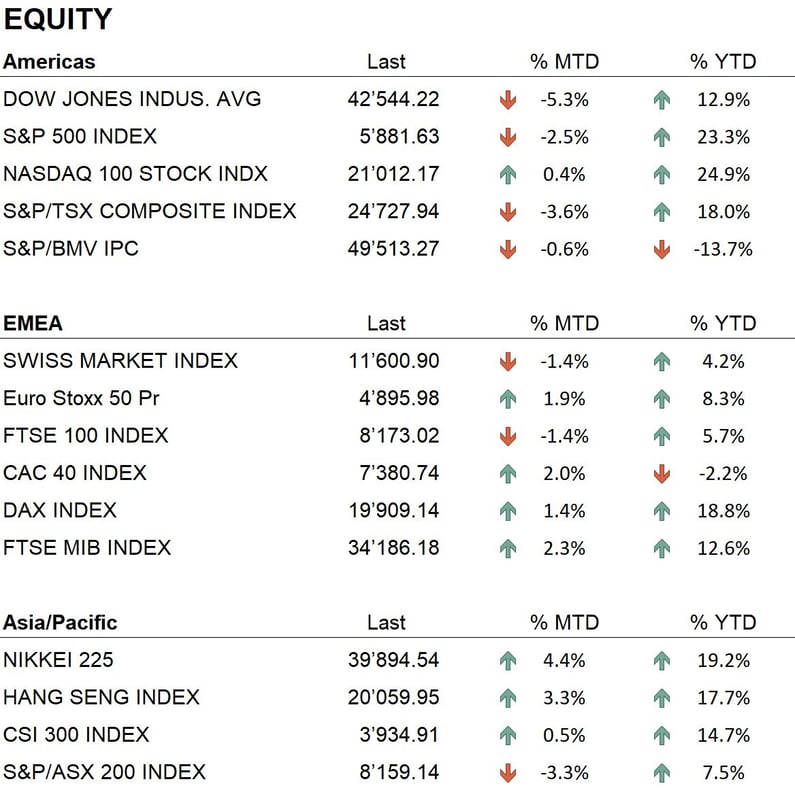

The year 2024 ended on a positive note for almost all major global indices, with some exceptions in Asian markets. In U.S. indices: Dow Jones +12.9%, S&P 500 +23.3%, Nasdaq 100 +24.9%. In Europe: Eurostoxx 50 +8.3%, FTSE 100 +5.7%, DAX +18.8%, CAC 40 -2.2%, FTSE MIB +12.6%. The Nikkei closed the year up +19.2%, while Hong Kong's Hang Seng gained 17.7%, driven by favorable macroeconomic factors and stimulus measures implemented by the Chinese government.

The performance of U.S. stock markets was driven by the outstanding results of the technology sector. Stocks such as Nvidia, Meta, and Microsoft benefited from the ongoing expansion of artificial intelligence applications and interest in technological transitions. However, 2024 was not a linear year: after a strong start in the early months and a summer slowdown, markets accelerated in November, buoyed by Donald Trump's presidential victory, which raised expectations for pro-business fiscal policies. This event, along with signals of less restrictive monetary policies, bolstered market confidence.

Bond markets experienced a year of sharp fluctuations, mainly due to central bank decisions and global economic dynamics. In the United States, yields on 10-year Treasuries peaked at 4.7% in April, driven by expectations of tighter monetary policies. Subsequently, they fell to 3.6% in September, thanks to an economic slowdown that increased demand for safe-haven securities. In the last quarter, yields stabilized, ending the year at 4.57%.

In Europe, 10-year Bunds followed a less pronounced trajectory, reaching a high of 2.64%, influenced by inflation concerns and tensions between the core and peripheral Eurozone economies. The year-end yield of 2.37% highlights the ECB’s cautious stance as it seeks to balance economic stability and inflationary pressures.

On the currency front, the U.S. dollar showed mixed performance against major currencies. The EUR/USD ended the year down 6.2%, reflecting the strength of the U.S. currency, supported by tight monetary policies and robust economic growth. The Swiss franc retained its safe-haven status, gaining 7.8% against the dollar and 1.2% against the euro, closing the year at a EUR/CHF rate of 0.940. This trend underscores investors' preference for stable currencies in a globally uncertain environment.

As for precious metals, gold closed the year at $2,620 per ounce, up 27.2%. This growth was driven by macroeconomic and geopolitical uncertainty, which made gold a more attractive option compared to other assets. Bitcoin ended 2024 at $93,000, a remarkable increase of 123.5%. The cryptocurrency's rally was fueled by the January approval of the first spot ETFs in the United States, the April halving, and Trump's victory, which included vocal support for cryptocurrencies. These events pushed Bitcoin's price to record levels in the final quarter, solidifying its role as a strategic asset.

Economy

In 2024, the global economy demonstrated significant resilience despite geopolitical uncertainty and escalating international conflicts. In the United States, inflation remained under control, ending the year at 2.8% year-on-year, partly due to a Federal Reserve monetary policy that was less restrictive than expected. Interest rates were cut in the second half of the year to a range of 4.50%-4.75%, despite earlier expectations of a more aggressive approach in early 2024.

In Europe, economic growth remained weak, with Eurozone GDP increasing by only 0.3% in the last quarter, impacting the manufacturing sector. Inflation stabilized at 2%, but challenges persist for manufacturing, particularly in Germany, which continues to struggle with weak global demand.

In Asia, China reported GDP growth of 4.7% in 2024, driven by economic stimulus policies that boosted consumption and exports. However, the real estate sector remains a major source of risk. In Japan, inflation remained stable at 1.3%, with moderate economic growth supported by exports and domestic investments.

Looking ahead to 2025, the economic outlook remains uncertain. Analysts project a slowdown in global growth, with increased reliance on expansionary fiscal policies to address structural challenges. Nonetheless, reduced inflationary pressures and more accommodative monetary policies could create a favorable environment for a stronger recovery in the second half of the year.

Geopolitics

The U.S. presidential election was the main geopolitical event of 2024. Donald Trump's victory, securing a second non-consecutive term, raised questions about the future of international relations. His protectionist policies and unilateral approach to foreign policy have heightened expectations of increased trade tensions, particularly with China and Europe.

In the Middle East, the situation remained critical, marked by an escalation of clashes between Israel and armed groups. Israel intensified operations against Hezbollah and Hamas, while the International Criminal Court issued arrest warrants for Netanyahu and other senior officials over alleged war crimes.

In Ukraine, the conflict with Russia continues with no signs of resolution. New European sanctions further restricted Russian energy exports, intensifying pressure on gas prices. The need to accelerate the transition to renewable energy sources has become a priority for Europe, with significant investments planned for 2025.

Conclusions

2024 was a complex yet positive year for global markets, shaped by significant geopolitical and macroeconomic events. Despite the resilience of equity markets, we believe it is prudent to adopt a cautious stance given ongoing geopolitical uncertainties and potential macroeconomic risks.

Equity exposure remains slightly overweight, while liquidity has been marginally increased to a neutral level, with a corresponding reduction in bond exposure. We maintain a strategic focus on gold, which continues to provide essential protection in an environment of economic and geopolitical uncertainty. Additionally, we favor the Financials, Communication Services, and Consumer Discretionary sectors, which we consider particularly attractive at this time.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Communication Services

- Consumer discretionary

Market data (data as of 31.12.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.