Index

Markets

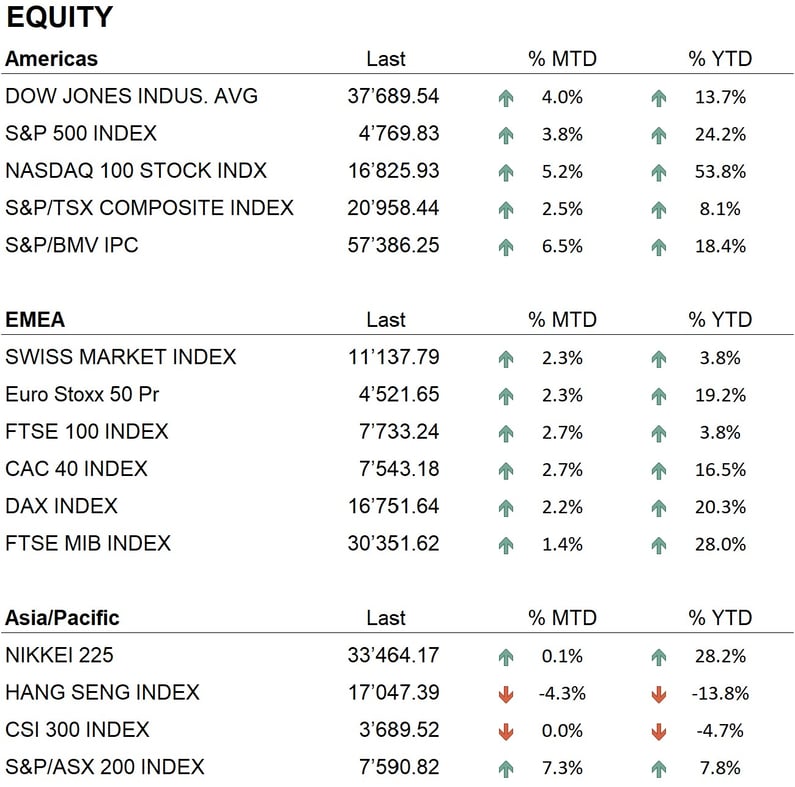

The year 2023 concluded on a largely positive note for nearly all major global indices, except for the Chinese indices, which experienced a negative close of approximately -13%. The U.S. markets showed robust performance, with the Dow Jones rising by 13.7%, the S&P 500 by 24.2%, and the Nasdaq 100 by 53.8%. European indices also ended positively: the Eurostoxx 50 grew by 19.2%, the FTSE 100 by 3.8%, the DAX by 20.3%, the CAC 40 by 16.5%, and the FTSE MIB by 28%. In Asia, the Nikkei closed the year with a 28.2% gain, while Hong Kong saw a decline of 13.8%.

The U.S. stock markets benefited greatly from the stellar performance of the technology sector, notably the FAANG index (comprising Meta, Apple, Amazon, Netflix, Alphabet) along with Microsoft and Nvidia, which nearly doubled their value. The success of these stocks can be attributed largely to the advancements in artificial intelligence and its widespread applications. However, the trajectory of 2023 was far from linear, marked by several peaks and troughs. The markets began strongly in January and maintained good performance until July. However, there was a decline until the end of October, with certain indices, like the Dow Jones and the Swiss SMI index, nearing negative territory. A significant turnaround occurred at the end of October when the market radically shifted its perspective on the future monetary policy of the Federal Reserve, which indicated a nearing end to the cycle of interest rate hikes. This shift sparked a major rally in the equity markets, leading some to close the year at historic highs.

The bond markets also experienced significant movements throughout the year. It started with the U.S. banking crisis in March and followed by notable bankruptcies in both the U.S. and Europe, including Credit Suisse. The aggressive stance of central banks, characterized by continual increases in benchmark rates, drove bond yields to their highest levels in 16 years against the dollar (around 5%) and in 12 years against the euro (approximately 3%) by late October. In this context, bond yields fell into negative territory by the end of October, and it seemed that 2023 would mark the third consecutive year of negative performance in the bond sector. However, a shift in the Federal Reserve's monetary policy triggered a rally that led the bond sector to close the year on a positive note. Credit spreads also saw impressive gains, buoyed by the decrease in rates and the bullish trend in equities.

On the currency front, the dollar had a mixed year. By the year's end, the Dollar Index, which tracks the dollar's strength against a basket of international currencies, showed a modest decline of less than 2%. The Swiss Franc emerged as the strongest currency of 2023, gaining significantly against both the dollar and the euro, and reaching new all-time highs. In the realm of precious metals, gold, which had shown a relatively stable trend throughout the year, soared to new all-time highs in December against both the dollar and the euro, underscoring the persistent demand for safe-haven assets. In the cryptocurrency market, 2023 was a year of recovery. Bitcoin, starting the year at around USD 16,000, closed near USD 43,000, in anticipation of the halving event expected in April 2024.

Economy

In 2023, defying the expectations of numerous analysts, major global economies did not enter a recession. The United States demonstrated remarkable economic resilience. Despite fluctuations in interest rates, economic growth remained robust. In contrast, Europe faced a different scenario. The economies there were significantly influenced by the European Central Bank's monetary policy, leading to varied impacts across the region. For instance, Germany experienced a mild recession. In Asia, China's economic performance was notably underwhelming, largely attributed to a prolonged and severe crisis in the real estate sector.

Geopolitics

In 2023, international tensions escalated significantly. The conflict between Russia and Ukraine has yet to show any signs of resolution. This is particularly true following the unsuccessful Ukrainian counteroffensive in the summer and the intense Russian military response that followed in recent weeks. The situation in the Middle East also remains fraught with tension. The ongoing clashes between Israel and Hamas in the Gaza Strip suggest no near resolution of the conflict. Additionally, escalating tensions in southern Lebanon, coupled with Iran's indirect involvement, raise concerns about the potential expansion of this conflict. In Asia, tensions between China and Taiwan are particularly high as the Taiwanese elections, scheduled for mid-January, approach, an event that might further intensify regional tensions.

Conclusions

The year 2023 concluded on a positive note for both stock and bond markets, overshadowing the challenges faced in 2022. The trend on major international stock exchanges remained upbeat, even though the valuations in certain key sectors are no longer deemed affordable. Nonetheless, the anticipation of interest rate cuts by central banks in 2024 may sustain this positive momentum. In the bond market, there seems to be an overestimation of potential rate cuts by central banks, setting the stage for a potentially eventful 2024. This is particularly true if the current downward trend in inflation does not persist. Amidst this backdrop, several factors, including ongoing conflicts, pose risks that could negatively impact the markets. Our stance remains that effective portfolio diversification is the optimal strategy to navigate the uncertainties of 2024.

We wish everyone a peaceful 2024.

The key distinction between an investor and a speculator resides in their attitudes towards stock market movements. A speculator primarily aims to anticipate market fluctuations and capitalize on them for profit. In contrast, an investor's focus is on acquiring and maintaining securities that are traded at reasonable prices.

Benjamin Graham, British-American economist and investor (1894-1976).

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Industrials

- Energy

Market data (data as of 31.12.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.