Index

Markets

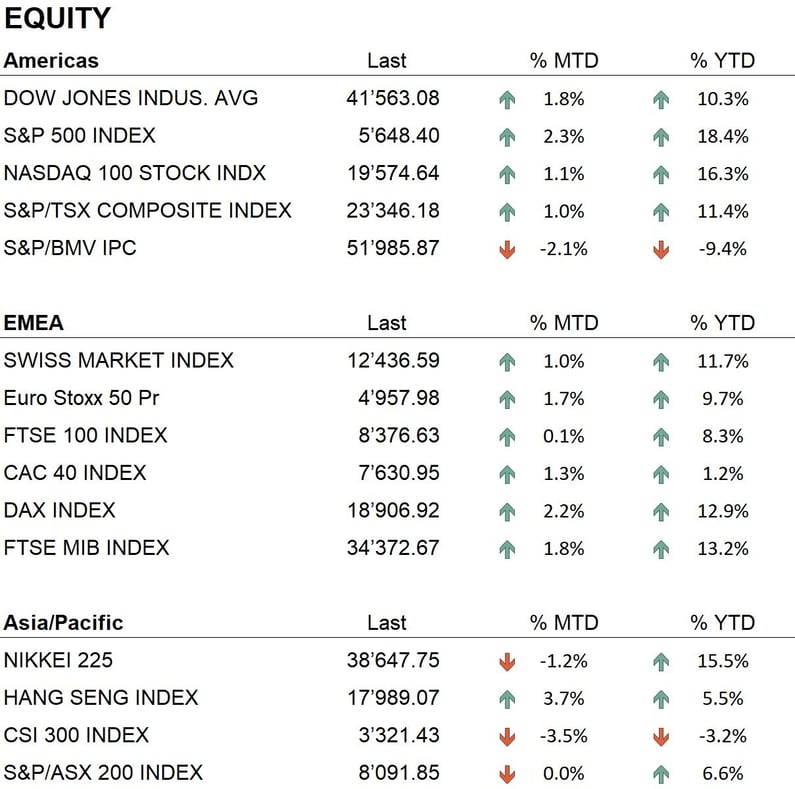

Between July and August 2024, global markets exhibited significant volatility. During July and the first weeks of August, the major indexes experienced substantial declines, with the S&P 500 dropping by 9%, while the Nasdaq 100 fell by 15% from its July highs. However, the indexes subsequently regained much of the lost ground. In Europe, the Eurostoxx 50 and DAX also suffered notable losses of 7% and 5%, respectively. In Asia, the NIKKEI fell particularly sharply, declining by 20.5%, with one especially severe day where the index dropped by 12.4%. Despite this high volatility, markets demonstrated remarkable resilience, recovering much of their losses towards the end of August.

The S&P 500, in particular, reached new all-time highs, underscoring the robustness of the U.S. market despite ongoing economic and geopolitical challenges. Since the beginning of the year (YTD), the index has risen by 18.4%. The Nasdaq 100 also recovered significantly, approaching its previous highs (+16.3% YTD), while the Dow Jones further consolidated its performance (+10.3% YTD), maintaining a positive trend.

In Europe, although the indexes showed more moderate performances, the Eurostoxx 50 (+9.7% YTD), DAX (+12.9% YTD), and SMI (+11.7% YTD) managed to limit their losses and stabilize, benefiting from a recovery in investor sentiment towards the end of the summer.

In the bond market, during July and August 2024, USD and EUR yields declined significantly, reflecting a growing consensus among investors that the Federal Reserve is poised to start a round of rate cuts after concluding its rate hike cycle. This shift in expectations was further solidified by Jerome Powell's speech at the Jackson Hole symposium, where he clearly signaled the possibility of a more accommodative approach by the Fed, particularly in light of the latest weaker-than-expected economic data, especially concerning economic growth and unemployment.

These market expectations helped reduce 10-year Treasury yields, which fell from nearly 4.50% to 3.9% over the summer months. Looking ahead, the Federal Reserve is expected to begin cutting interest rates as early as its next meeting in September, with further cuts possible by the end of the year. In Europe, the European Central Bank (ECB) may follow a similar trajectory as inflation continues to decline. In Switzerland, the Swiss National Bank (SNB) may take a more cautious approach, but markets are beginning to price in the possibility of rate easing there as well, in line with global trends.

As for precious metals, gold reached new record highs, surpassing $2'500 an ounce. Silver also performed well, with its price reaching $30 an ounce before closing the month at $28.86.

In the cryptocurrency market, Bitcoin experienced a correction in July and August 2024 after peaking at over $71,000 in May. By the end of August, Bitcoin's value had settled around $59,000. Similarly, Ethereum saw a significant decline, closing the month of August around $2,515. This follows a period of volatility for the second-largest cryptocurrency by market capitalization, which had previously benefited from the launch of a spot ETF on Ethereum but now reflects pressure from the broader market.

Economy

During the summer of 2024, signs of slowing inflation in the United States became more evident. In June, the consumer price index showed an annual increase of 3.0%, with a slight decline on a monthly basis. Subsequently, July data confirmed this trend, indicating that price increases are continuing to slow, with an annual increase of 2.9%. The economic situation in Europe at the end of August 2024 shows mixed signals. Economic growth remains weak, with GDP expected to increase by 0.8% in the euro area and 1.0% in the European Union as a whole for the year. On the inflation side, recent data show a continued slowdown, with inflation in the euro area falling to 2.6%.

Geopolitics

The conflict between Russia and Ukraine escalated between July and August 2024, with intense Russian attacks in the Kharkiv and Donetsk regions. Ukrainian forces, supported by new military and economic aid from NATO, opened a new front on Russian territory in the Kursk region, capturing several hundred square kilometers. The situation remains very critical, with growing concerns about civilian and military casualties.

The situation in Israel worsened in late July 2024, when Hamas leader Ismail Haniyeh was killed in an attack in Tehran. This event further exacerbated tensions between Israel and Iran, while clashes in Gaza continued with intensity. Tensions along the border with Lebanon also increased, with Hezbollah escalating its threats, leading to growing concern about a possible widening of the conflict.

Conclusions

Overall, financial markets showed remarkable resilience during July and August 2024, despite an initial period of volatility. Expectations of monetary policy easing by major central banks, particularly the Federal Reserve, contributed to the rebound in equity indices in late August. However, the bond market remains marked by uncertainties related to future interest rate decisions, with yields continuing to reflect expectations of more accommodative monetary policy. Geopolitical tensions, especially in Ukraine and the Middle East, are a persistent risk that could affect market volatility in the coming months. In this context, gold could continue to benefit from growing demand as a safe haven asset, while equity markets will face challenges related to global economic uncertainties.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Information Technology

- Healthcare

Market data (data as of 30.08.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.