Index

Markets

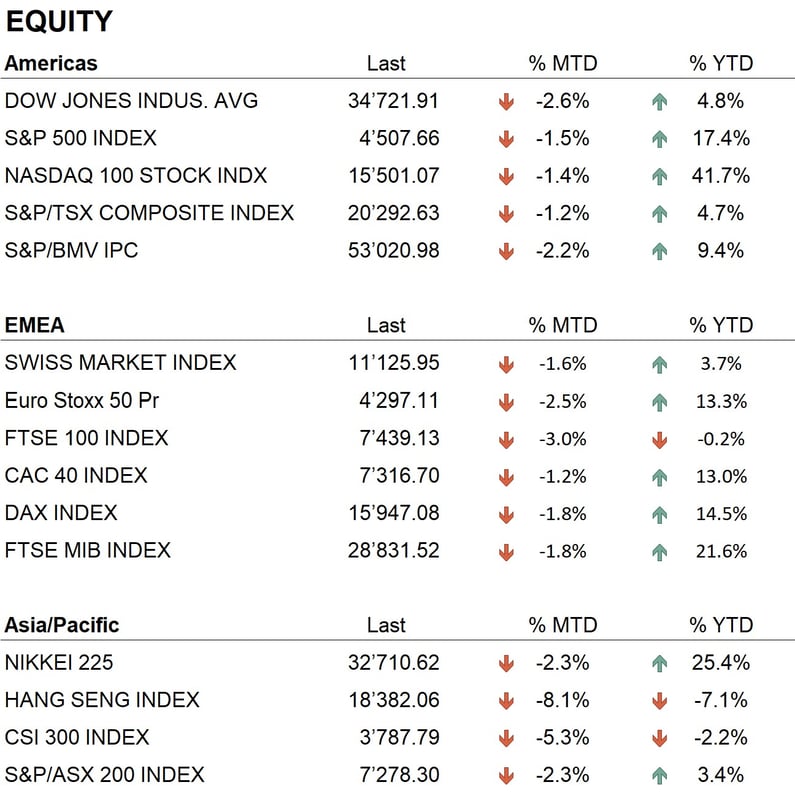

The month of August ended with negative performances on all major world stock exchanges. U.S. indices declined ranging from -2.6% for the Dow Jones to -1.4% for the Nasdaq100; in Europe, indices lost about 2% on average, while in Asia, the Nikkei posted a loss of 2.3%, but China's major indices showed negative performances ranging from -5% to -8%. Despite this, performance since the beginning of the year remains largely positive, with the S&P 500 index registering +17.4%, the Nasdaq100 +41.7%, and European indices having performances ranging from +13.3% for the EuroStoxx50 to +16% for the Spanish IBEX and +22% for the Italian FTSE MIB. In Asia, Japan stands out with +25%, while Hong Kong posted a negative performance of 7%. Chinese indices are the only ones to have a negative performance since the beginning of the year. China has been hit by a major crisis in the real estate sector, in which giants such as Evergrande (with debt of $300 billion) and Country Garden (with debt of $200 billion) have defaulted on some coupons on bonds issued, thus finding themselves in a state of technical default. The real estate sector in China accounts for about 28% of GDP and has been in crisis for a couple of years, following the government's severe restrictions on bank lending to heavily indebted real estate groups.

During the month, data for the second quarter of 2023 of U.S. companies were released, and the results were on average higher than analysts' expectations. The best performing sectors were technology and consumer staples.

On the bond front, August was a lull for central banks after the benchmark rate hikes made in July. The main event of the month was the annual meeting of central bankers, held as is tradition in Jackson Hole, Wyoming. However, no particular news emerged: Fed Chairman Powell, as well as ECB President Lagarde, emphasized that the fight against inflation is not yet over and that, as a result, following the data to be published in the coming months, further interest rate hikes cannot be ruled out. The market had no particular reaction to these statements, and rates remained at the levels seen in the weeks leading up to the meeting. On U.S. government bonds, two-year bonds yield around 4.9%, while 10-year bonds yield around 4.10%. The rate curve remains inverted, signaling that expectations of a coming recession are still valid. In Europe, an inversion of the curve is also observed, although less pronounced than in the United States: two-year German bonds yield around 3.10%, while 10-year bonds yield around 2.55%.

In the currency context, during the month we witnessed a strengthening of the dollar, which against the euro went from a level of 1.10 to a level of 1.09. As for the cryptocurrency sector, Bitcoin went down, losing about $3,200 during the month, going from a level of 29'000 to a level of $25,950. As for metals, gold showed a sideways trend and closed the month at $1'945 an ounce.

Economy

Regarding the performance of economies, August saw the release of data regarding GDP in both the United States and Europe. In the United States, the GDP increase in the second quarter was 2.4%, in line with analysts' expectations, while in Europe the performance was much more modest, with an increase of only 0.6%. Germany's negative performance was noteworthy, with negative growth of 0.6%. Inflation data were in line with analysts' expectations: in the U.S., inflation registered an annual increase of 3.2%, while in Europe the annual increase was 5.3%. As mentioned earlier, these inflation data still worry central banks, which now find themselves in a very delicate position, with inflation far from the ideal target of 2% and economic growth slowing markedly in some countries.

Geopolitics

During August, the war conflict between Russia and Ukraine did not see any particular developments. The Ukrainian offensive, expected in the summer, seems not yet to have produced the expected results, despite the substantial arms support provided to Ukraine by the West.

An interesting event of the month was the Brics meeting held in South Africa, during which it was announced that starting in January 2024 there will be an enlargement of the group, with Saudi Arabia, the United Arab Emirates, Egypt, Ethiopia, Iran and Argentina joining. With these new members, the Brics will account for nearly 30% of the world's GDP, 46% of the world's population and 43% of the world's oil production. It was also announced at the summit that several countries are on the waiting list to join the club, including, for example, Belarus, Venezuela, Vietnam, and Indonesia. The basic idea of the group's leading countries, such as China, is to create an alternative to the G7 bloc and achieve a high degree of economic and financial independence.

Conclusions

Trends in the world's major stock markets continue to be positive, despite a slight decline that occurred during the month. Uncertainties remain related to the Russia-Ukraine conflict, the Chinese real estate crisis and its aftermath, and slowing global growth.

The leading sectors in the major markets are technology, industrial and energy, following the release of quarterly data.

Our investment policies maintain a neutral exposure on equities, while on bonds the average duration of the portfolios has fallen slightly and is on the more profitable end of the curve.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Industrials

- Energ

Market data (data as of 31.08.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.