Index

Markets

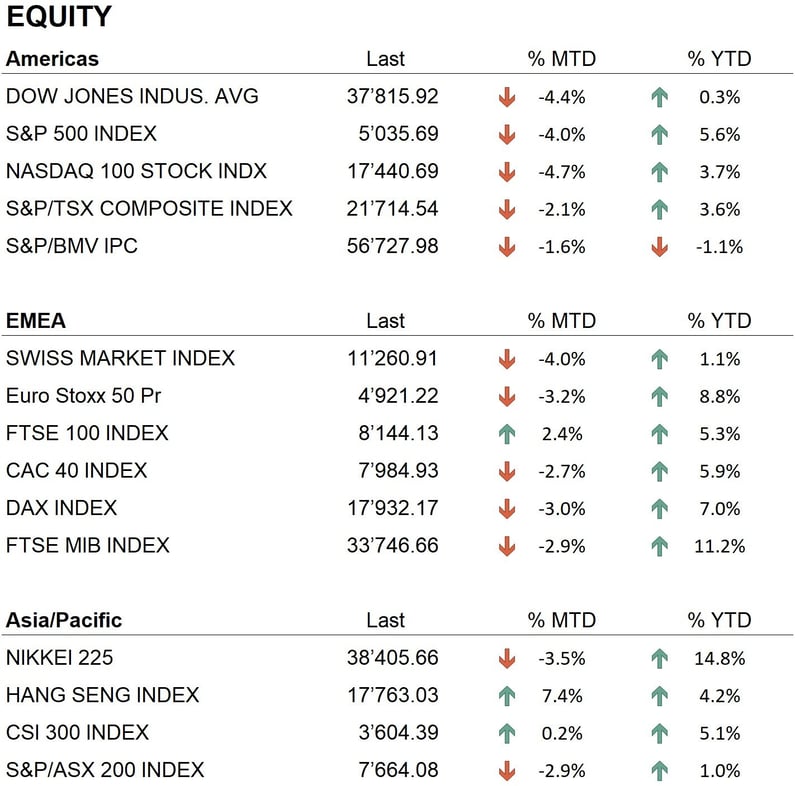

April saw a decline in the values of the world's major stock exchanges, interrupting the rally that had started in October 2023. During the month, major U.S. indices lost around 4%, yet they remained in positive territory since the beginning of the year: the S&P 500 recorded a 5.6% gain, and the Nasdaq 100, a 3.7% gain. In Europe, the correction was less marked, with indices losing an average of 3%. The yearly trend there also continues to be positive, with the Eurostoxx 50 at +8.8%, the DAX at +7%, the FTSE MIB at +11.2%, and the SMI at +1.1%. In Asia, the month's outcomes were mixed, with the Nikkei declining by about 3.5%, while the Hong Kong stock exchange advanced by 7.4%, returning to positive territory since the start of the year. This downward movement represents a correction within the broad uptrend that began in late October 2023, part of a still-positive medium-to-long-term trend.

The bond sector witnessed significant volatility during the month. The release of the latest U.S. inflation data showed that inflation persists, and, contrary to market expectations, rate cuts by the Federal Reserve have been delayed. Initially expected as early as May, these are now anticipated towards the end of summer. In Europe, inflation was less severe, prompting the European Central Bank to prepare for rate decrease starting in June. Consequently, rates increased, especially in the U.S., leading to a further decline in bond valuations and keeping major global bond indices in negative territory.

On the currency front, the dollar appreciated slightly against major currencies, following the rate increases in the U.S. mentioned above. Notably, the dollar strengthened against the yen, which reached 30-year lows. Regarding cryptocurrencies, Bitcoin exhibited a mostly lateral movement after reaching new all-time highs above $70,000 earlier in the month. Gold also recorded new historical highs during the month, surpassing the $2,400 per ounce mark twice, fueled by reports of frequent physical gold purchases by Asian central banks.

Economy

During the month, the latest U.S. inflation data release disappointed markets, as figures surpassed both monthly and annual expectations. Another disappointing aspect for the U.S. economy was its economic growth for the first quarter of 2024, which was only 1.6%, below the expected 2.5%. In Europe, the inflation data were positively received, as they came in below analysts' forecasts and reinforced the downward inflation trend. Despite this, the overall economic indicators showed signs of slowing. In Asia, China's economic growth figure positively surprised, reporting an annual increase of 5.3%, which was above the anticipated 4.8%. This suggests that the Chinese government's economic stimulus measures are effective, notwithstanding the ongoing real estate sector crisis.

Geopolitics

The international geopolitical scene did not show any signs of improvement in April. The conflict between Russia and Ukraine remains intense, with Russian forces gaining and consolidating territory. On the Ukrainian side, there has been a significant call for additional military and economic support from NATO countries. Notably, the U.S. Congress recently authorized a substantial aid package worth $61 billion. In the Middle East, the continued Israeli occupation in the Gaza Strip has exacerbated the humanitarian situation. Allies of Israel are pressing strongly for Netanyahu to agree to a truce that would allow humanitarian aid to reach those in need.

Conclusions

Despite the correction in April, the financial markets' situation remains positive in the equity sector, with the medium- to long-term trend still intact. However, the bond market faces a more complicated situation, worsened by recent significant shifts in the expected monetary policies of central banks. High volatility is anticipated in this sector in the coming months, heavily influenced by upcoming inflation data. In this environment, the dollar is expected to maintain its relative strength against major currencies, and gold is likely to continue benefiting from robust demand from both central banks and retail investors.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Industrials

- Information Technology

- Communication services

Market data (data as of 30.04.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.