Index

Markets

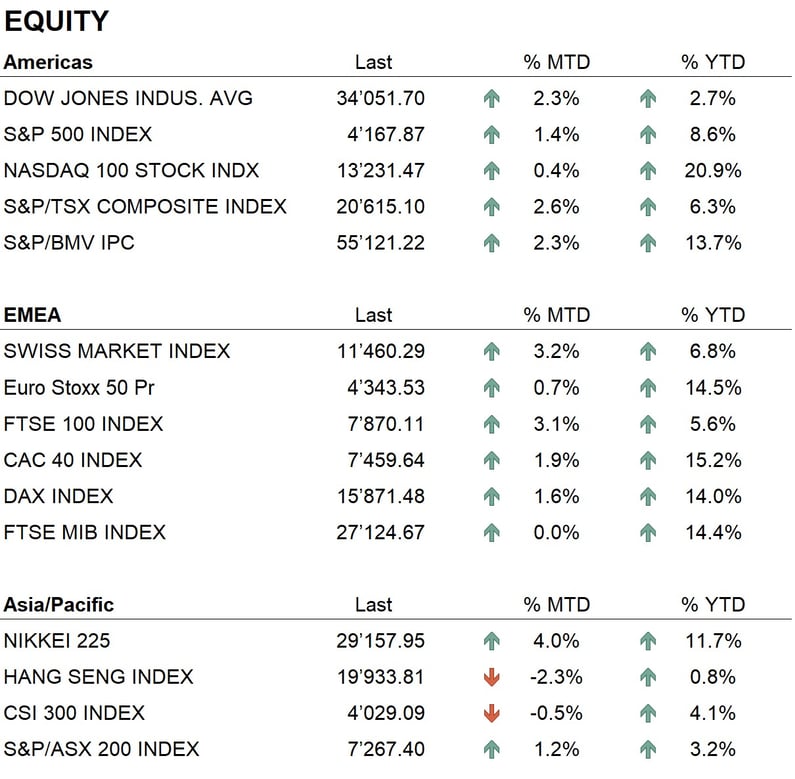

The month of April ended with a mixed picture on the world's major stock markets. Indeed, in the US, the Dow Jones closed slightly positive with a performance of 2.4%, while the Nasdaq closed with an unchanged performance. In Europe, all indices were slightly positive, with the Eurostoxx 50 at 1.7%.

There were no particularly noteworthy events during the month. Let us therefore say that, after a turbulent March, April was a month of consolidation characterised by the publication of many quarterly reports which, for the most part, surprised positively, exceeding analysts' expectations.

On the global bond markets, the past month was a month of sideways movement for dollar rates, which closed practically unchanged on the entire curve with the two-year in the 4% area and the 10-year in the 3.5% area. Euro rates, on the other hand, saw a slight increase on the short-term side with the German two-year closing the month in the 2.80% area and the 10-year in the 2.40% area. Credit spreads also closed the month unchanged, consolidating the levels reached after the descent in the second half of March.

The currency market saw a weakening of the dollar against all major currencies. Against the euro it reached the level of 1.11, the lowest in over a year, while against the Swiss franc it touched the area of 0.88, which had not been seen for about two years. The weakness of the dollar brought gold prices close to all-time highs, reaching USD 2’050 per ounce.

Economy

On the economic front, in April 2023, we had the release of inflation data, which showed a slowdown in inflation in both the US and Europe. Headline inflation in the US increased by 5% year-on-year, while core inflation, that is without the more volatile items such as food and energy, increased by 5.6% year-on-year. Both figures were in line with market expectations. In Europe, the data were higher than in the US, with headline inflation rising by 6.9% per year and core inflation by 5.7%. In Europe, the data was also exactly in line with analysts' expectations. In addition to this, we had the release of Q1 GDP data. In Europe, GDP saw a timid 0.2% increase, while in the US the annualised increase was 1.1%, below analysts' expectations of a 1.9% increase. This figure shows a slowdown in the US economy.

In April, the US and European central banks had a month-long break, and the next monetary policy decisions will be announced after meetings in the first week of May. Here, expectations for the Federal Reserve are for a 0.25% increase, bringing rates to 5.25%, which could also represent the end of the rate hike cycle, at least until the end of the summer. For the ECB, on the other hand, expectations are for a 0.50% increase in the benchmark rate to 4%.

The world's major economies continue to grow at a modest pace and many analysts expect a recessionary scenario in the second half of the year. At the moment, however, some leading indicators are still giving positive signals. Hence the difficulty in interpreting the current scenario, especially for central banks and their monetary policies.

Geopolitics

The international geopolitical situation saw no improvement during the month of April. The conflict between Russia and Ukraine continues unabated, the only new development being the first talks between the Chinese and Ukrainian presidents, suggesting a possible mediation by China between the two belligerents. In Asia, tensions continue between China and the US over the Taiwan issue, with the Chinese army carrying out military exercises around the island and American warships cruising in the vicinity. China continues to expand its influence through alliance and cooperation agreements with various countries. In this regard, it is worth mentioning Brazilian President Lula's visit to Beijing in recent days and the fact that the Chinese yuan has become the Brazilian Central Bank's second reserve currency after the US dollar, surpassing the euro. In the United States, Biden has announced his candidacy for the presidential elections to be held next year, so another duel between Biden and Trump in the next election is looming.

Conclusions

The financial markets remain in a positive medium-term trend, supported mainly by the technology sector, where major stocks such as Microsoft, Google, Amazon, etc. have reported positive quarterly figures and announced important developments in the artificial intelligence sector. The developments seen in this sector in recent weeks have opened up new horizons in the technology sector. All the big players are focusing on this new topic with huge investments, which shows significant potential for development and will bring radical changes in many areas. The most important game, however, is still that of the central banks against inflation. After months of very aggressive monetary policy, the central banks have reached a first milestone: inflation has stopped rising and is slowly falling. This, however, does not yet represent the final victory, as the central banks' inflation targets are all in the 2% area, thus far from the current levels. That said, in the world of rates, we will be navigating by sight in the coming months and investment decisions will be made on the basis of the economic growth and inflation data that will be published from time to time. At this stage, alternative assets such as precious metals and cryptocurrencies remain attractive.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Energy

- Industrials

- Information Technology

Market data (data as of 1.05.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.