Index

Markets

October 2025 was a month of consolidation for global equity markets, with volatility declining and trading activity becoming more subdued after the strong gains of the summer months. The prospect of a gradual rate-cutting cycle by the Federal Reserve, together with stable bond yields, supported a positive yet more cautious tone.

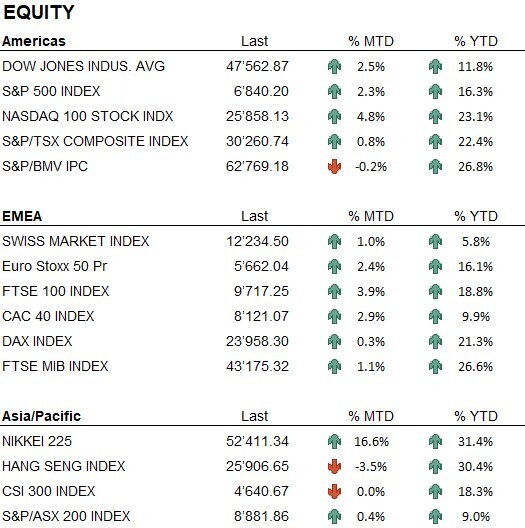

In the United States, the S&P 500 rose 2.3% to above 6,800 points, while the Nasdaq 100 gained 4.8%. The Dow Jones closed up 2.5%, driven by a recovery in the industrial sector.

In Europe, equity markets recorded moderate gains: the Euro Stoxx 50 advanced 2.4%, the CAC 40 rose 2.9%, and the FTSE 100 climbed 3.9%, supported by expectations of further rate cuts and generally solid corporate earnings. The German DAX remained broadly unchanged (+0.3%), while the Swiss SMI gained 1.0%.

In Asia, the Nikkei 225 posted an exceptional +16.6%, as the depreciation of the yen boosted exports and business confidence. The Chinese CSI 300 was flat, while Hong Kong’s Hang Seng Index declined 3.5%.

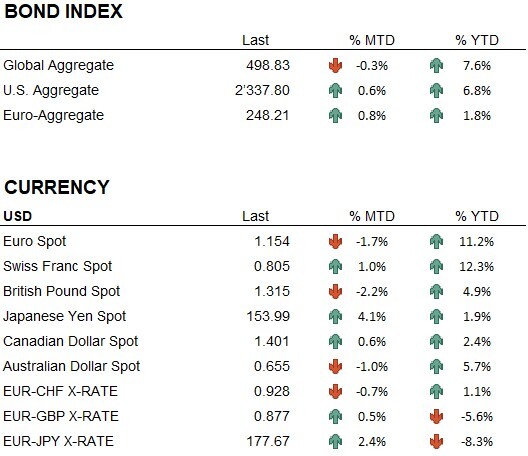

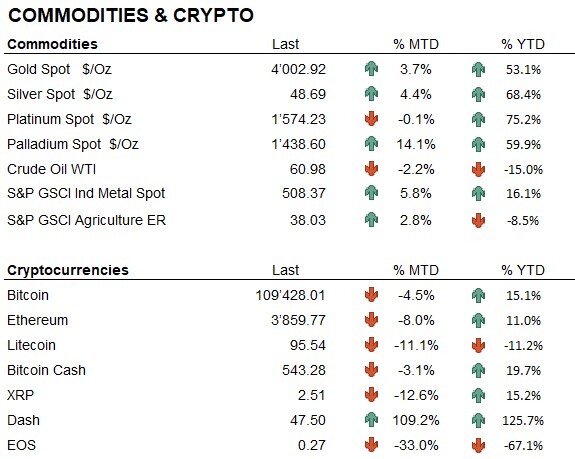

Gold ended October at $4,002.9 per ounce (+3.7% for the month, +52.3% year-to-date), continuing its bullish trend and reaching new all-time highs. On the currency front, the US dollar strengthened: EUR/USD fell 1.7% to 1.154, while USD/CHF rose 1.0% to 0.805, with the franc maintaining its appeal as a defensive asset.

In the cryptocurrency market, Bitcoin closed at $109,428 (-4.5% for the month, +14.7% year-to-date), while Ethereum fell 8.0% to $3,860 (+10.9% year-to-date). After the strong summer rally, the sector entered a period of stabilization.

In the United States, the prolonged federal shutdown and ongoing trade tensions with China and Canada fueled caution. Investors remained prudent heading into year-end, awaiting inflation data and upcoming Federal Reserve decisions that will determine market direction in the final months of 2025.

Economy

At its meeting on October 28–29, the Federal Reserve cut interest rates by a further 25 basis points, bringing the target range to 3.75%–4.00%, against the backdrop of the prolonged federal government shutdown. Jerome Powell reiterated that, although inflation remains slightly above target, the slowdown in the labor market and the decline in consumer confidence justify a more accommodative stance. However, the central bank emphasized that future policy decisions will depend on macroeconomic data, much of which remains incomplete due to the administrative shutdown.

The shutdown—now entering its fourth week—has begun to weigh on economic activity. The release of several key indicators has been delayed, and consumer spending has shown signs of weakness, fueling concerns about a potential slowdown in the fourth quarter. In mid-October, new trade tensions arose with China, which announced restrictions on rare earth exports. Toward the end of the month, President Trump suspended free trade negotiations with Canada following the broadcast of an anti-tariff commercial in Ontario, adding further uncertainty to North American trade relations.

In Europe, the European Central Bank left its deposit rate unchanged at 2.00%, maintaining its “meeting-by-meeting” approach. Christine Lagarde reiterated the need to assess inflation and growth dynamics before adjusting monetary policy. While eurozone inflation has fallen to 2.1%, service-sector prices remain elevated. The institution is therefore maintaining a cautious stance, awaiting additional macroeconomic data.

Geopolitics

In the Middle East, tensions remained high throughout October. In the Gaza Strip, despite a US-brokered ceasefire agreement, Israel intensified its military operations, while Hamas continued to launch rockets into southern Israel—highlighting the fragility of the truce.

On the Ukrainian front, Russia carried out a large-scale assault on Ukraine’s energy infrastructure, triggering blackouts in the regions of Kyiv, Odesa, and Chernihiv. Kyiv responded with targeted strikes deep inside Russian territory. Meanwhile, President Trump revived the idea of a trilateral summit with Presidents Zelenskyy and Putin to discuss a possible truce or a freezing of the front lines, opening a potential new diplomatic channel.

Conclusions

In October, we maintained our portfolio positioning, keeping an overweight stance in equities and a balanced exposure across the main investment areas. Our allocation to gold remained slightly overweight, consistent with the tactical choices made in recent months. Overall, the month was marked by subdued market movements and gradually declining volatility following the sharp rises observed during the summer.

On the bond side, we marginally increased portfolio duration, supported by a more stable inflation outlook and a more proactive Federal Reserve in the US dollar area. In Europe, yields declined slightly across the curve, while in Switzerland the yield curve remained flat, reflecting a stable monetary environment and contained inflation.

From a strategic standpoint, we believe the current approach remains appropriate for this phase of the market. Although signs of a slowdown are emerging, the macroeconomic environment remains broadly solid, with central banks oriented toward a gradual normalization of monetary policy. Active and flexible management will continue to be essential in maintaining a balanced and responsive positioning as we approach the final months of the year.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Information Technology

- Materials

- Communication Services

Market data (data as of 31.10.2025)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.