Index

Markets

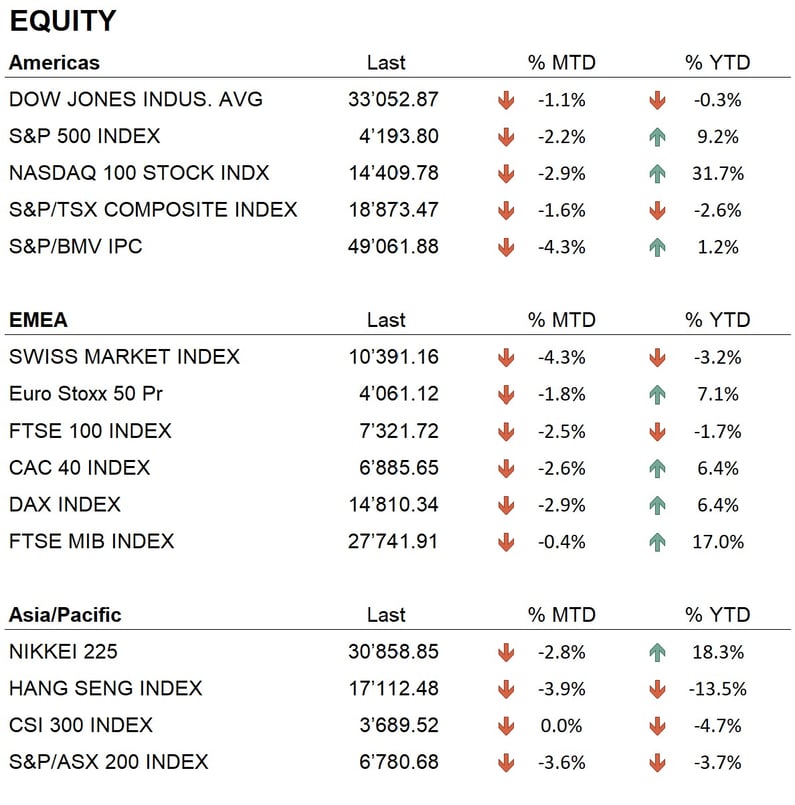

The month of October closes with negative performances on all major stock exchanges worldwide. The U.S. indices perform negatively with the Dow Jones losing about 1.1%, the S&P 500 2.2% and the Nasdaq 2.9%; in Europe, the Eurostoxx 50 loses 1.8%, the DAX 2.9% and the Swiss stock exchange performs negatively at -4.3%. In Asia, losses range from 3.9% in the Hang Seng to 2.8% in the Nikkei. The negative October closings, which follow those of September, further reduce the performance of the stock markets for 2023. For example, the Dow Jones at the end of October zeroes out its YTD performance, and the Swiss SMI index posts a negative YTD performance of -3.2%. Performance for the year still remains positive for the S&P 500 with +9.2%, the Nasdaq 100 with +31.7%, the Eurostoxx 50 with +7.1%, the DAX with +6.4% and the Nikkei with +18.3%. As for the U.S. market, the quarterly reports that have been released so far have shown still positive sales and earnings trends, confirming good momentum in the U.S. economy.

As for the bond market, the month of October was characterized by very high volatility in rates on the medium-long end of the curve. The U.S. 10-year, which had started the month around 4.50%, came in at 5%, which is the highest level since 2007. In Europe, we also saw a rise, but it was much milder than in the United States; the German Bund, which had started the month around a level of 2.7%, came in to touch 3%, and then closed the month around 2.8%. The rise in rates and the negative performance of the stock markets also affected credit spreads, which rose across all rating classes during the month. That said, the month of October boosted the negative performance of global bond indices, such as the U.S. Treasury index, which performs at -4.5% since the beginning of the year.

In the currency sector, the month of October saw a stabilization of USD quotations against the major currencies; in fact, against the euro, the USD moved in a range between 1.05 and 1.06. International geopolitical tensions and the outbreak of war in the Middle East led to a strengthening of safe-haven assets, such as the Swiss franc, which against the euro hit a new all-time low, and gold, which surpassed USD 2’000 per ounce, approaching an all-time high. Regarding cryptocurrencies, during the month, we saw a major movement of Bitcoin, which had started the month in the USD 27’000 area and in the last few sessions touched a level of USD 35’000.

Economy

In the economic sphere, we had the release of some data concerning the third quarter GDP growth of the major economies. In the U.S., the annualized growth was 4.9%, which was a very good figure, above market expectations that were positioned at 4.5%, showing that the U.S. economy continues to be quite buoyant, despite the many rate hikes by the central bank. In Europe, the first data on GDP growth were published in Germany and turned out to be slightly above expectations, although still in negative territory; the quarterly figure shows growth of -0.1% and confirms the recessionary situation of the German economy. Regarding price trends, inflation figures were updated in both Europe and the United States. In Europe, year-on-year inflation stands at the level of 4.3%, down from 5% in the previous month, but still far from the ECB's desired 2% target. In the United States, year-on-year inflation came in at 3.7%, up slightly from the previous month. During the month, we had only the European Central Bank meeting, which, as a monetary policy choice, decided to leave rates unchanged, given the decline in inflation and also the slowdown in the economy.

Geopolitics

The international geopolitical situation definitely deteriorated in October due to the attack by the Palestinian group Hamas against Israel. This opens up a new front of war in the Middle East that, at the moment, only Israelis and Palestinians are officially involved; however, the situation could escalate and involve other countries such as Lebanon, Syria and, most importantly, Iran. The situation in the Middle East is currently the point of greatest tension globally and has diverted attention from the other conflict between Russia and Ukraine, which seems to have reached a stalemate, with neither side able to improve its position. At the global level, the rift between the West and the so-called "Global South," represented by the BRICS+ group, led by China and Russia, is becoming increasingly evident. The war in the Middle East is also having a strong social impact in Europe and the United States, where the many Muslim communities have begun demonstrating in the streets in support of the Palestinians.

Conclusions

Global equity markets remain in a short-term negative phase that began as early as during September. However, the medium- to long-term trend is still positive, and the current phase should be regarded, in our opinion, as a physiological decline within a broader movement. The bond sector, on the other hand, is still in a downtrend that began more than two years ago. The restrictive policies of central banks seem to have come to an end; therefore, we expect rate levels to stabilize at current values for the foreseeable future. That said, our approach to the markets remains cautious, both on the equity side, where we maintain a slight underweight, and on the bond side, where we keep a short duration.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Energy

- Information Technology

- Financials

Market data (data as of 31.10.2023)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.