Index

Markets

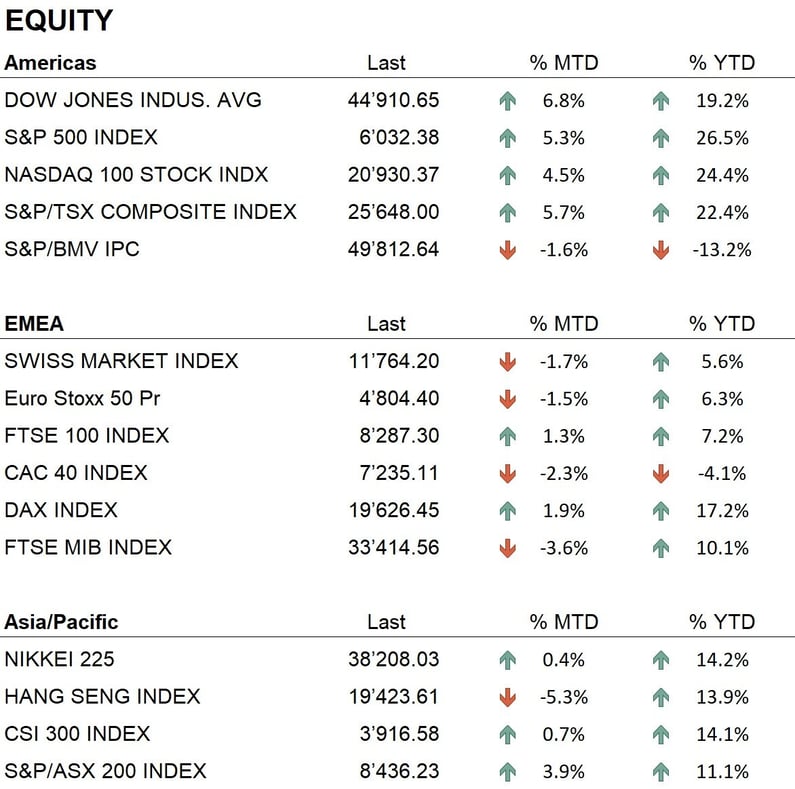

The November 5, 2024, U.S. presidential election, which saw Donald Trump win, had a significant impact on global markets, fueling volatility and affecting the dynamics of several asset classes. In the United States, markets reacted positively to the news, with investors encouraged by the prospects of pro-business economic policies. The S&P 500 closed the month up 5.3%, driven by the energy and financial sectors. The Nasdaq 100 rose 4.5%, while the Dow Jones posted a 6.8% increase, supported by expectations of favorable new economic measures.

In Europe, markets showed mixed performances, with the Eurostoxx 50 closing down 1.5%, the Swiss SMI down 1.7%, and the British FTSE 100 up 1.3%. The French CAC 40 lost 2.3%, while the German DAX closed the month up 1.9%.

In Asia, China’s CSI 300 index gained 0.7%, while Hong Kong’s Hang Seng fell 5.3%. In Japan, the Nikkei 225 closed up 0.4%.

The gold market declined, closing the month at $2,643 an ounce, down 3.4%. Bitcoin, however, posted a significant rally, closing at $97,460, supported by optimism about more favorable regulation in the United States and record inflows into spot ETFs.

Economy

In November 2024, U.S. inflation data for October was released, showing a year-on-year increase of 2.6%, up from 2.4% in September and in line with economists' forecasts. On a monthly basis, the increase was 0.2%. “Core” inflation, which excludes volatile components such as food and energy, remained stable at 3.3% year-on-year and 0.3% month-on-month. This trend was mainly driven by rising prices in the housing sector, while energy had a neutral impact.

On November 7, the Federal Reserve cut interest rates by 25 basis points to the 4.50%-4.75% range. The decision was motivated by the goal of supporting the economy amid moderate inflation and subdued growth signals. However, the Fed indicated that further reductions could be limited due to uncertainties in financial markets and the appropriate level of interest rates needed to balance growth and inflation.

In Europe, data released in November for October showed that inflation increased to 2%, up from 1.7% in September. Germany recorded GDP growth of 0.1% in the third quarter, reflecting a modest recovery constrained by persistent challenges in manufacturing and weakening global demand. The Eurozone as a whole posted a 0.2% increase, supported by the services sector but hindered by the slow recovery in industry.

At its October 24 meeting, the ECB kept rates unchanged, confirming that the current level is adequate to support the recovery and achieve price stability in the medium term.

In Asia, China showed signs of recovery, with GDP expected to grow 4.5% in the fourth quarter. November exports rose 6% year-on-year, indicating a partial recovery in global demand following last year’s slowdown. Government stimulus measures, including rate cuts and fiscal incentives, have supported the economy, although structural challenges such as the slowdown in the real estate sector remain. In Japan, inflation remained stable at 1.3%.

Geopolitics

The U.S. presidential election was the main geopolitical event of November 2024. Donald Trump’s victory, securing a second nonconsecutive term, raised questions about the future of international relations. His protectionist stance and assertive foreign policy positions have created expectations of escalating trade tensions, particularly with China and Europe.

In the Middle East, tensions remained high, with an escalation of clashes between Israel and armed groups. Israel intensified its operations against Hezbollah and Hamas, while the International Criminal Court issued arrest warrants for Prime Minister Netanyahu and other senior officials over alleged war crimes. These developments significantly impacted energy markets, increasing oil price volatility.

In Ukraine, the conflict with Russia continues with no signs of resolution. New European sanctions have further restricted Russian energy exports, intensifying pressure on gas prices. This situation highlights the urgency for Europe to accelerate its transition to renewable energy sources.

Conclusions

The month of November 2024 proved crucial for global markets, with the U.S. presidential election and geopolitical tensions taking center stage. Donald Trump's victory has fueled mixed expectations: on one hand, pro-business fiscal policies could support economic growth; on the other, the risk of renewed trade tensions remains high.

In Europe, geopolitical instability and economic challenges continue to hinder growth. In Asia, positive signals from China and Japan provide some grounds for optimism, particularly in sectors linked to the energy transition.

In this context, we continue to maintain a slightly overweight exposure in the Equity segment, while adopting a cautious stance toward assets more sensitive to interest rates. We favor the Financials and Communication Services sectors, with strategic exposure to gold as a hedge against market uncertainty.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Financials

- Communication Services

- Industrials

Market data (data as of 29.11.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.