Index

Markets

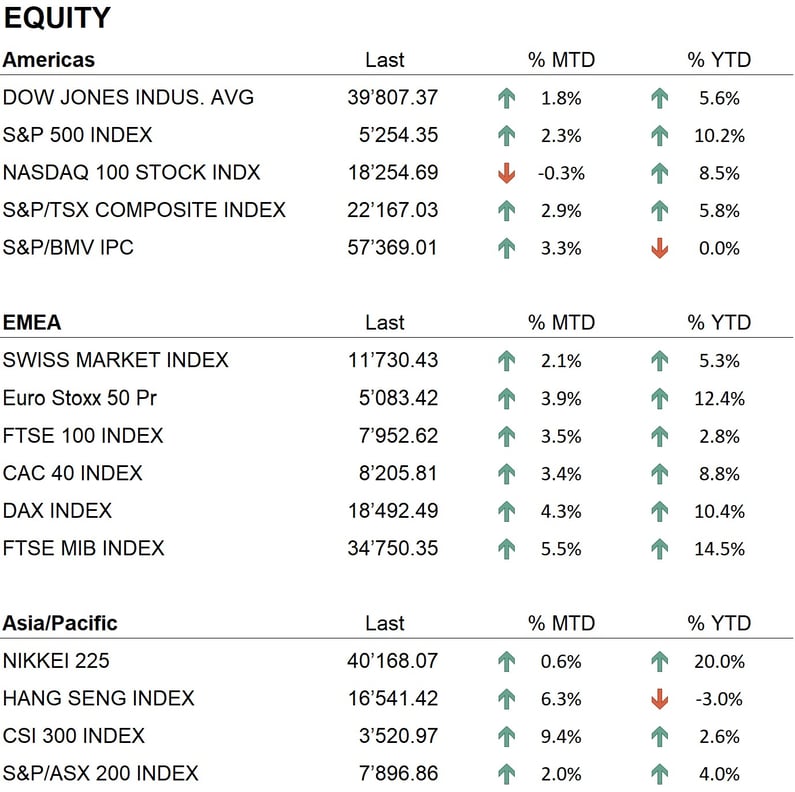

The month of March was, from a stock market perspective, very positive. In fact, many of the world's major indexes reached their all-time highs. For example, the three U.S. indexes—the Dow Jones, S&P 500, and Nasdaq—touched new heights. In Europe, the German DAX and the French CAC also recorded new all-time highs. In Asia, Japan's Nikkei index surpassed the old record set some 34 years ago. Performance since the beginning of the year has been positive for all major world indexes: the S&P 500 (+10%), Nasdaq (+9%), Eurostoxx 50 (+12%), and Nikkei (+20%), while Chinese indexes remain in negative territory, with a loss of about 3%. The positive trend in the stock markets, which began last October, has been characterized by low volatility, the absence of significant corrections, and relative strength in the technology sector, where the group of stocks called the New York FAANG has posted a performance since the beginning of the year of more than 15%. As for the bond sector, performance was generally negative. During the month, we witnessed increased volatility in rates, following the release of inflation data in some countries, and central bankers' comments on future monetary policy moves. The Global Aggregate bond index, which includes more than 30,000 bonds with a value of about $65 billion, issued in both developed and emerging markets, has performed about -2% since the beginning of the year. The U.S. Treasury index scores -2.8%, while in the euro area the situation is slightly better, with the Euro Aggregate index losing only 0.5% since the beginning of the year. On the currency front, the month saw increased volatility in the dollar's quotations against major currencies. In fact, the greenback closed the month at 1.0790 against the euro, after touching the 1.10 level, and against the Japanese yen it reached the highest level in 35 years, with quotations above ¥150 per dollar. The month was also eventful on cryptocurrencies, where Bitcoin reached a new all-time high above $70,000, and on metals, with gold surpassing $2,200 per ounce, setting a new all-time high.

Economy

On the economic front, the month saw the release of the latest inflation data in Europe and the United States, revealing a downward trend, although the results were slightly above expectations. In Europe, the annual inflation rate stood at 2.6%, while in the United States, it reached 3.2%. European GDP data were also released, indicating a stationary trend, with 0% growth in the fourth quarter of 2023 and a modest 0.1% year-on-year increase. Economic growth in the United States, however, remains quite robust, with the latest annual GDP growth figure showing an increase of 3.2%. As for the central banks' monetary policies, the inflation data have solidified the assumption that the Federal Reserve and the European Central Bank may start cutting interest rates as early as early summer. As a result, the market expects three rate cuts, each by 0.25%, by both institutions in 2024.

Geopolitics

International geopolitical tensions remain elevated across various conflict zones. In the confrontation between Ukraine and Russia, there have been recent partial successes on the Russian side, including the capture of some positions on the ground. There is also growing speculation about the potential resolution of the conflict through the creation of new autonomous entities within Russian-occupied regions. In the Middle East, the situation continues to be extremely grave, especially for civilians in the Gaza Strip. Despite efforts by the U.N. and U.S. to establish a lasting truce and find a resolution to the conflict, Israeli military actions persist. Furthermore, in the Middle East, ongoing attacks by Yemen's Houthi rebels are disrupting shipping routes between Asia and Europe via the Suez Canal, forcing vessels to take the lengthy alternative of circumnavigating Africa. This situation leads to logistical delays and increased transportation costs.

Conclusions

The outlook for international financial markets continues to be positive, especially within the equity sector. The achievement of numerous all-time highs indicates a robust market likely to maintain its momentum. However, given the current valuation levels, we cannot dismiss the possibility of a market correction or consolidation phase in the near future. The bond sector, having exhibited some weakness, is anticipated to rebound in the coming months as central banks begin to implement monetary easing policies. Additionally, it is crucial to closely monitor the dollar's performance in the currency market and, importantly, the developments in cryptocurrencies and gold, which are currently experiencing significant capital inflows. In conclusion, our investment strategy remains in line with the approach taken in the previous month, with a slight preference for equity and precious metals, particularly gold.

Allocation

Liquidity

Bonds

Equity

Precious metals & Commodities

Geo-tactical allocation

Switzerland

Western Europe ex Switzerland

North America

Latin America

Asia Pacific

Top sectors

- Industrials

- Information Technology

- Communication services

Market data (data as of 29.03.2024)

Event calendar

Legend

|

CPI: Consumer Price Index GDP: Gross Domestic Product FOMC: Federal Open Market Commitee BOJ: Bank of Japan |

FED: Federal Reserve System EIB: European Investment Bank BOE: Bank of England SNB: Swiss National Bank |

ZEW: Zentrum für Europeische Wirtschaftsforschung (Center for European Economic Research) YoY: Year on Year MoM: Month on Month |

Disclaimer: the content of this document is provided by i Partners SA (hereinafter iP) for information purposes only and is intended for internal use only. It does not in any way constitute an offer or recommendation to buy or sell a security or to carry out any type of transaction. Nor does it constitute any other type of advice, in particular to any recipient who is not a qualified, accredited, eligible and/or professional investor. It is to be used solely by its recipient and must not be forwarded, printed, uploaded, used or reproduced for any other reason. iP, cannot guarantee that the information contained herein is relevant, accurate or comprehensive. Accordingly, iP and its directors, officers, employees, agents and shareholders accept no responsibility for any loss or damage that may result from the use of the information contained herein. The content is intended solely for recipients who understand and bear all implicit and explicit risks involved. iP assumes no responsibility for the suitability or unsuitability of the information, opinions, securities or products mentioned herein. Past performance is no guarantee of future performance.